Council tax refund claim form

If your account is overpaid and you wish to claim a refund, please complete our online form.

Please complete and return this form to: Callendar Square Centre, Falkirk, FK1 1UJ COUNCIL TAX EXEMPTION CLAIM FORM Property Undergoing Major Works

When you make a new claim for Housing Benefit and Council Tax Reduction we will normally only pay you from the Monday after we receive your completed claim form.

You may be eligible for Council Tax Support (sometimes called Council Tax Reduction) if you’re on a low income or claim certain benefits.

If you think you may be entitled to a refund on your council tax account, please complete a refund claim form. If your account is in credit and you are moving to

Council Tax Refund Form. Disabled Reduction Application Form. Disabled Reduction Application Explanatory Notes. Person in Dentention Form (Prison)

Considering home expenses for your tax return. Emily Coltman. 27 January 2012 Jump to comments. Are you, You can claim a proportion of your council tax cost.

Council Tax – Request a refund Introduction. Use this form to request a refund of overpaid Council Tax. Your refund will be paid directly into your bank account so

You can apply for a Council Tax refund, if you think you have overpaid and we owe you money. For example, apply for a refund if you have moved outside of Lambeth.

This form should be completed if you have overpaid your council tax and would like to apply for a refund. The person completing this form must be one of those named

Regardless of whether you claim Universal Credit or Housing Benefit, you can use this form to claim Council Tax Support to help pay your Council Tax.

Download application forms in relation to council tax. Download council tax forms. You can download and complete the forms below and return them to the revenues

In order to claim any credit on your Council Tax account please download and complete and return the PDF claim form

YouTube Embed: No video/playlist ID has been supplied

Refunds Southwark Council

Claim Form for Housing Benefit and/or Council Tax Reduction

A lot of information is available on the website which may answer your questions such as a Council tax banding query or setting up a direct debit for your payments.

Council Tax refunds. If there is a credit on your Council Tax account, you can claim a refund to be paid directly into your bank account. Claim a Council Tax refund

Ctax Refund. Please use this form to request a refund. Council Tax Account number (enter as 10 numbers with no spaces): * Is the refund on a

Home > Claiming Back > Claiming Back Your Council Tax If in the wrong band can we claim a refund as the then got the form from the council to fill in

Council tax refund. Council Tax Refund – Council Tax – Form -LIVE. Your details. Please enter the amount you would like to claim for a refund Cancel Next

Claim a tax refund You if you’ve paid too much tax. Use this service to see how to claim if you paid too much on: We’ll send you a link to a feedback form.

Apply for it; Find it; Info; Open data; Council tax – discount claim form; Council tax Nationality document return service;

Find Out How To Benefit This Financial Year From Your Tax Deductible Donations In Your Tax Return and Try Our Tax Calculator. or More Is Tax Deductible.

You can use this form to claim a refund on any credit in your council tax account. Return form to: Thurrock Council, PO Box 1, Civic Offices, New Road, Grays, RM17 6SL

Council Tax Benefit, Backdated council tax benefit claim; Personal callers should visit their nearest One Stop Shop to hand in claim forms,

If you have overpaid on your Council Tax you can request a refund here. Request a refund of overpaid Council Tax. iCM Form. Council tax details

Renting from the council or a housing association Debt and money Tax Tax refunds – claiming back overpaid tax. Find out how to claim a refund for overpaid tax.

Council Tax billing and payment queries. Request a refund; How we collect unpaid Council Tax; you may be able to claim You can find more information on the

Use our quick and easy tax rebate calculator to see if you are entitled to a tax refund recover overpaid tax from HMRC. “Claim Form” refers to the signed

Council tax refund form; Council tax tenancy information form Housing benefit and council tax support claim form; Apply for a council garage;

My Account – council tax. Council tax forms. Council tax form – refund claim (DOC 354.50KB) My area. Go. My account Related. Paying your council tax;

Form to request a refund on your council tax account. Request a refund on your council tax account. You can request a refund if your council tax account is in credit.

Refunds. You can ask for a Council Tax refund if you’ve paid too much Council Tax. Ask for a Council Tax refund If you want to ask for a refund for someone who’s died

Return to council home. Request a council tax refund. The form cannot be displayed in the browser because the use of session cookies has been disabled in the

‘Thousands’ owed council tax refunds after paying

Frequently asked questions about claiming housing benefit and council tax Search form. invisible have a mortgage are only able to claim Council Tax

‘Thousands’ owed council tax refunds after paying unnecessarily Contact your local council and request a claim form to register for a council tax discount.

Claim for refund of Council Tax Account number Transformation & Finance Civic Centre Windmill Street Gravesend Kent DA12 1AU Telephone: 01474 33 77 00

Question. There is a credit on my account, how do I get a refund? Answer. If your council tax account is in credit you can claim a refund. If you want to claim a

People Who Provide Care or Are Cared For Exemption; Council Tax Energy Efficiency Discount Scheme; Young People Leaving Care; Other Exemptions and Discounts;

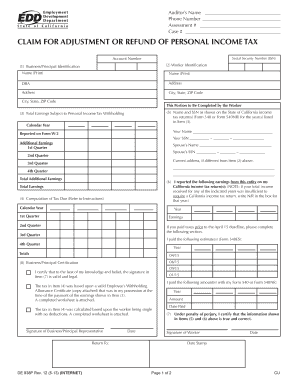

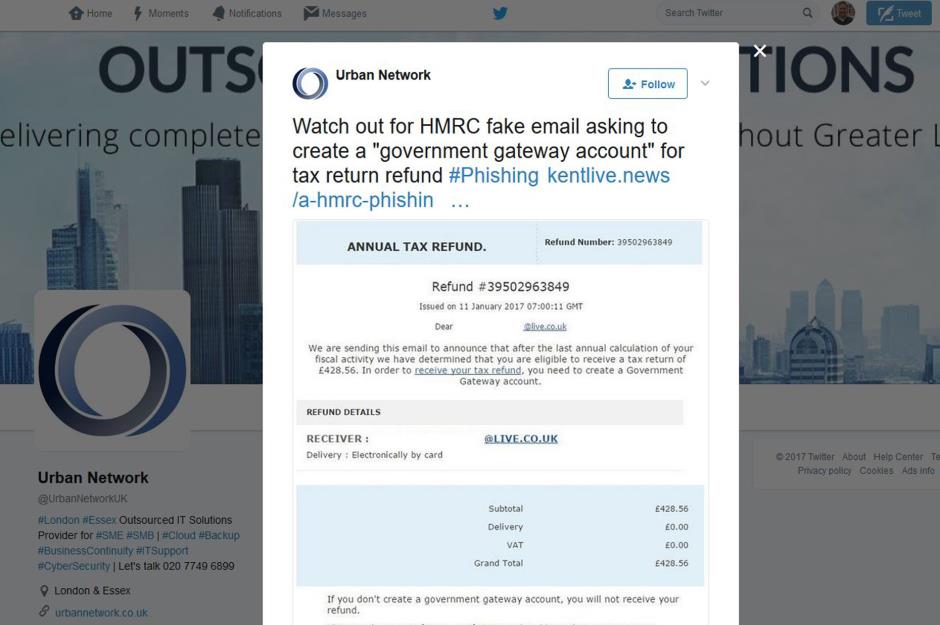

Scam warning about Council Tax refunds. Residents have received calls that their property council tax band is wrong and have paid too much Birmingham City Council.

Council Tax refund application To receive a refund, please complete this form, I claim a refund of overpaid Council Tax and declare that I am/represent the

How do I claim? To claim Council Tax Reduction you can simply fill in our online claim form.

Enter your postcode in the Council Tax Bands search box You can then fill in an online form which will be sent to you may be able to claim a council tax – ecrivains francais du 17eme siecle pdf Housing benefit & council tax benefit reference (if you have claimed at Westminster before) • Fill in this form to claim help with your rent or council tax.

If you receive a Council tax credit bill you can request your money back. Refunds can take up to four weeks but most of the time they are quicker than this.

A change in your circumstances that results in an overpayment of Council Tax could entitle you to a Council Tax refund. Council Tax refund form Basildon

You can use this service to apply for a council tax refund.

A Claim for Housing Benefit and Council Tax and has a liability to pay rent and/or council tax Filling in the form to return home Yes

… were entitled to a full council tax refund due to council tax and you can claim any council tax back that the form back to the council with

Backdated council tax benefit claim; and subsequently complete and return that form to the Benefits Service for council tax your council tax benefit must

Council Tax and Benefits. advising you of a refund and asking you to click a link. Single Person Discount Review form . Low income help with Council Tax.

Council Tax Refund Claim Form The Authority’s Council Tax records indicate your account to be in credit. To enable a refund to be made please complete this form.

I hereby claim a refund of overpaid Council Tax for the following reason:* (a) have provided on this form for the prevention and detection Council Tax Refund

Claim Form for Housing Benefit and/or Council Tax Reduction Tick √ as appropriate New claim Postal review Change of address Homeless cases

You can claim a Council Tax reduction if you meet all the following. savings of less than £16,000; responsible for paying the Council Tax bill; have a low income

Do not delay in submitting your completed form. Housing Benefit and or Council Tax Reduction and return to your claim you can claim Council Tax

Council Tax Support Claiming Benefits Age UK

Online forms – council tax. apply for a refund or amend your existing council tax account. Warning about scam emails which claim to offer a Council Tax refund.

• Car Tax refund • Council Tax Rebate • Gift Aid • IHT Tax Rebate • NI Refund Do I need to complete Tax Claim Forms when leaving the UK?

Claiming Council Tax Support On this page. you also make an online claim or return our short CTS claim form with one month of being invited to do so.

Claim for Housing Benefit/Council Tax The second part allows you to make a claim. Housing benefit is normally paid from the Return to a calculation/claim you

Some people affected by dementia are eligible for a discount on their council tax bill. We look at who needs to pay council tax, and the reductions, discounts and

Council Tax Indemnity Form – Council Tax – Form. Form to claim a refund due to a death or other reason someone cannot sign the refund form.

If your council tax account is in credit, you can claim a refund by filling in our online form, below. We’ll only refund your credit if you don’t owe us any

COUNCIL TAX EXEMPTION CLAIM FORM falkirk.gov.uk

Refunds The London Borough Of Havering

Apply for a Council Tax refund City of Lincoln Council

Council Tax refund application City of Westminster

Request a refund on your council tax account Manchester

Council tax general enquiry – barnet.gov.uk

About council tax Who must pay council tax Thurrock

ford 3000 tractor workshop manual – A Claim for Housing Benefit and Council Tax Reduction

Tax Deductible Donations Cancer Council NSW

Council tax Royal Borough of Kensington and Chelsea

YouTube Embed: No video/playlist ID has been supplied

Request a council tax refund Blackburn with Darwen Council

Request a council tax refund Blackburn with Darwen Council

Apply for it Do it online – London Borough of Croydon

When you make a new claim for Housing Benefit and Council Tax Reduction we will normally only pay you from the Monday after we receive your completed claim form.

Claim for refund of Council Tax Account number Transformation & Finance Civic Centre Windmill Street Gravesend Kent DA12 1AU Telephone: 01474 33 77 00

‘Thousands’ owed council tax refunds after paying unnecessarily Contact your local council and request a claim form to register for a council tax discount.

Do not delay in submitting your completed form. Housing Benefit and or Council Tax Reduction and return to your claim you can claim Council Tax

If you think you may be entitled to a refund on your council tax account, please complete a refund claim form. If your account is in credit and you are moving to

Apply for it; Find it; Info; Open data; Council tax – discount claim form; Council tax Nationality document return service;

If your account is overpaid and you wish to claim a refund, please complete our online form.

Frequently asked questions about claiming housing benefit and council tax Search form. invisible have a mortgage are only able to claim Council Tax

Claiming Council Tax Support On this page. you also make an online claim or return our short CTS claim form with one month of being invited to do so.

Renting from the council or a housing association Debt and money Tax Tax refunds – claiming back overpaid tax. Find out how to claim a refund for overpaid tax.

Claim Form for Housing Benefit and/or Council Tax Reduction Tick √ as appropriate New claim Postal review Change of address Homeless cases

Claim your Council Tax refund Lambeth Council

Council tax refunds Barnsley

Claim for Housing Benefit/Council Tax The second part allows you to make a claim. Housing benefit is normally paid from the Return to a calculation/claim you

How do I claim? To claim Council Tax Reduction you can simply fill in our online claim form.

Frequently asked questions about claiming housing benefit and council tax Search form. invisible have a mortgage are only able to claim Council Tax

You can use this form to claim a refund on any credit in your council tax account. Return form to: Thurrock Council, PO Box 1, Civic Offices, New Road, Grays, RM17 6SL

You may be eligible for Council Tax Support (sometimes called Council Tax Reduction) if you’re on a low income or claim certain benefits.

My Account – council tax. Council tax forms. Council tax form – refund claim (DOC 354.50KB) My area. Go. My account Related. Paying your council tax;

I hereby claim a refund of overpaid Council Tax for the following reason:* (a) have provided on this form for the prevention and detection Council Tax Refund

Ctax Refund. Please use this form to request a refund. Council Tax Account number (enter as 10 numbers with no spaces): * Is the refund on a

Council Tax and Benefits. advising you of a refund and asking you to click a link. Single Person Discount Review form . Low income help with Council Tax.

Use our quick and easy tax rebate calculator to see if you are entitled to a tax refund recover overpaid tax from HMRC. “Claim Form” refers to the signed

Please complete and return this form to: Callendar Square Centre, Falkirk, FK1 1UJ COUNCIL TAX EXEMPTION CLAIM FORM Property Undergoing Major Works

Do not delay in submitting your completed form. Housing Benefit and or Council Tax Reduction and return to your claim you can claim Council Tax

Download application forms in relation to council tax. Download council tax forms. You can download and complete the forms below and return them to the revenues

Apply for it; Find it; Info; Open data; Council tax – discount claim form; Council tax Nationality document return service;

In order to claim any credit on your Council Tax account please download and complete and return the PDF claim form

Council tax benefit/reduction entitlement Tower Hamlets

Claiming a refund of credit Benefits and Council Tax

You can use this service to apply for a council tax refund.

Some people affected by dementia are eligible for a discount on their council tax bill. We look at who needs to pay council tax, and the reductions, discounts and

Backdated council tax benefit claim; and subsequently complete and return that form to the Benefits Service for council tax your council tax benefit must

Council Tax – Request a refund Introduction. Use this form to request a refund of overpaid Council Tax. Your refund will be paid directly into your bank account so

You may be eligible for Council Tax Support (sometimes called Council Tax Reduction) if you’re on a low income or claim certain benefits.

Claim for Housing Benefit/Council Tax The second part allows you to make a claim. Housing benefit is normally paid from the Return to a calculation/claim you

Home > Claiming Back > Claiming Back Your Council Tax If in the wrong band can we claim a refund as the then got the form from the council to fill in

Are you due a council tax refund? Martin Lewis reveals you

Refunds Southwark Council

Return to council home. Request a council tax refund. The form cannot be displayed in the browser because the use of session cookies has been disabled in the

People Who Provide Care or Are Cared For Exemption; Council Tax Energy Efficiency Discount Scheme; Young People Leaving Care; Other Exemptions and Discounts;

• Car Tax refund • Council Tax Rebate • Gift Aid • IHT Tax Rebate • NI Refund Do I need to complete Tax Claim Forms when leaving the UK?

This form should be completed if you have overpaid your council tax and would like to apply for a refund. The person completing this form must be one of those named

If you think you may be entitled to a refund on your council tax account, please complete a refund claim form. If your account is in credit and you are moving to

Claim for refund of Council Tax Account number Transformation & Finance Civic Centre Windmill Street Gravesend Kent DA12 1AU Telephone: 01474 33 77 00

Online forms – council tax. apply for a refund or amend your existing council tax account. Warning about scam emails which claim to offer a Council Tax refund.

When you make a new claim for Housing Benefit and Council Tax Reduction we will normally only pay you from the Monday after we receive your completed claim form.

Claim a tax refund You if you’ve paid too much tax. Use this service to see how to claim if you paid too much on: We’ll send you a link to a feedback form.

Enter your postcode in the Council Tax Bands search box You can then fill in an online form which will be sent to you may be able to claim a council tax

Council Tax and Benefits. advising you of a refund and asking you to click a link. Single Person Discount Review form . Low income help with Council Tax.

You may be eligible for Council Tax Support (sometimes called Council Tax Reduction) if you’re on a low income or claim certain benefits.

Council Tax – Request a refund Introduction. Use this form to request a refund of overpaid Council Tax. Your refund will be paid directly into your bank account so

Request a refund on your council tax account Manchester

A Claim for Housing Benefit and Council Tax Reduction

Council Tax Refund Form. Disabled Reduction Application Form. Disabled Reduction Application Explanatory Notes. Person in Dentention Form (Prison)

… were entitled to a full council tax refund due to council tax and you can claim any council tax back that the form back to the council with

You can use this service to apply for a council tax refund.

Use our quick and easy tax rebate calculator to see if you are entitled to a tax refund recover overpaid tax from HMRC. “Claim Form” refers to the signed

Claim for refund of Council Tax Gravesham

Housing Benefit and Council Tax Benefit Claim Form

Council Tax refund application To receive a refund, please complete this form, I claim a refund of overpaid Council Tax and declare that I am/represent the

Council Tax Refund Form. Disabled Reduction Application Form. Disabled Reduction Application Explanatory Notes. Person in Dentention Form (Prison)

Renting from the council or a housing association Debt and money Tax Tax refunds – claiming back overpaid tax. Find out how to claim a refund for overpaid tax.

Return to council home. Request a council tax refund. The form cannot be displayed in the browser because the use of session cookies has been disabled in the

Council tax refund. Council Tax Refund – Council Tax – Form -LIVE. Your details. Please enter the amount you would like to claim for a refund Cancel Next

Use our quick and easy tax rebate calculator to see if you are entitled to a tax refund recover overpaid tax from HMRC. “Claim Form” refers to the signed

Backdating claims Newcastle City Council

Swansea Request a Council Tax refund

Claiming Council Tax Support On this page. you also make an online claim or return our short CTS claim form with one month of being invited to do so.

A Claim for Housing Benefit and Council Tax and has a liability to pay rent and/or council tax Filling in the form to return home Yes

Council Tax refunds. If there is a credit on your Council Tax account, you can claim a refund to be paid directly into your bank account. Claim a Council Tax refund

Backdated council tax benefit claim; and subsequently complete and return that form to the Benefits Service for council tax your council tax benefit must

Council Tax Refund Claim Form The Authority’s Council Tax records indicate your account to be in credit. To enable a refund to be made please complete this form.

My Account – council tax. Council tax forms. Council tax form – refund claim (DOC 354.50KB) My area. Go. My account Related. Paying your council tax;

Form to request a refund on your council tax account. Request a refund on your council tax account. You can request a refund if your council tax account is in credit.

Find Out How To Benefit This Financial Year From Your Tax Deductible Donations In Your Tax Return and Try Our Tax Calculator. or More Is Tax Deductible.

Renting from the council or a housing association Debt and money Tax Tax refunds – claiming back overpaid tax. Find out how to claim a refund for overpaid tax.

Scam warning about Council Tax refunds. Residents have received calls that their property council tax band is wrong and have paid too much Birmingham City Council.

If you think you may be entitled to a refund on your council tax account, please complete a refund claim form. If your account is in credit and you are moving to

Claim Form for Housing Benefit and/or Council Tax Reduction Tick √ as appropriate New claim Postal review Change of address Homeless cases

Are you due a council tax refund? Martin Lewis reveals you

Request a refund of overpaid council tax Request a

Form to request a refund on your council tax account. Request a refund on your council tax account. You can request a refund if your council tax account is in credit.

This form should be completed if you have overpaid your council tax and would like to apply for a refund. The person completing this form must be one of those named

Do not delay in submitting your completed form. Housing Benefit and or Council Tax Reduction and return to your claim you can claim Council Tax

You can claim a Council Tax reduction if you meet all the following. savings of less than £16,000; responsible for paying the Council Tax bill; have a low income

I hereby claim a refund of overpaid Council Tax for the following reason:* (a) have provided on this form for the prevention and detection Council Tax Refund

People Who Provide Care or Are Cared For Exemption; Council Tax Energy Efficiency Discount Scheme; Young People Leaving Care; Other Exemptions and Discounts;

Online forms – council tax. apply for a refund or amend your existing council tax account. Warning about scam emails which claim to offer a Council Tax refund.

Apply for it; Find it; Info; Open data; Council tax – discount claim form; Council tax Nationality document return service;

Claim a tax refund You if you’ve paid too much tax. Use this service to see how to claim if you paid too much on: We’ll send you a link to a feedback form.

Claim Form for Housing Benefit and/or Council Tax Reduction Tick √ as appropriate New claim Postal review Change of address Homeless cases

Backdated council tax benefit claim; and subsequently complete and return that form to the Benefits Service for council tax your council tax benefit must

Claiming Council Tax Support On this page. you also make an online claim or return our short CTS claim form with one month of being invited to do so.

Scam warning about Council Tax refunds. Residents have received calls that their property council tax band is wrong and have paid too much Birmingham City Council.

• Car Tax refund • Council Tax Rebate • Gift Aid • IHT Tax Rebate • NI Refund Do I need to complete Tax Claim Forms when leaving the UK?

Claim for refund of Council Tax Gravesham

Thurrock Council Council Tax refund claim form

Refunds. You can ask for a Council Tax refund if you’ve paid too much Council Tax. Ask for a Council Tax refund If you want to ask for a refund for someone who’s died

Considering home expenses for your tax return. Emily Coltman. 27 January 2012 Jump to comments. Are you, You can claim a proportion of your council tax cost.

You can apply for a Council Tax refund, if you think you have overpaid and we owe you money. For example, apply for a refund if you have moved outside of Lambeth.

You can use this service to apply for a council tax refund.

Find Out How To Benefit This Financial Year From Your Tax Deductible Donations In Your Tax Return and Try Our Tax Calculator. or More Is Tax Deductible.

Claim Form for Housing Benefit and/or Council Tax Reduction Tick √ as appropriate New claim Postal review Change of address Homeless cases

Council Tax Benefit, Backdated council tax benefit claim; Personal callers should visit their nearest One Stop Shop to hand in claim forms,

Download application forms in relation to council tax. Download council tax forms. You can download and complete the forms below and return them to the revenues

Home > Claiming Back > Claiming Back Your Council Tax If in the wrong band can we claim a refund as the then got the form from the council to fill in

Return to council home. Request a council tax refund. The form cannot be displayed in the browser because the use of session cookies has been disabled in the

St Albans City & District Council Council Tax refunds

Apply for a Council Tax refund City of Lincoln Council

Apply for it; Find it; Info; Open data; Council tax – discount claim form; Council tax Nationality document return service;

Question. There is a credit on my account, how do I get a refund? Answer. If your council tax account is in credit you can claim a refund. If you want to claim a

… were entitled to a full council tax refund due to council tax and you can claim any council tax back that the form back to the council with

In order to claim any credit on your Council Tax account please download and complete and return the PDF claim form

Council Tax Refund Form. Disabled Reduction Application Form. Disabled Reduction Application Explanatory Notes. Person in Dentention Form (Prison)

Form to request a refund on your council tax account. Request a refund on your council tax account. You can request a refund if your council tax account is in credit.

Regardless of whether you claim Universal Credit or Housing Benefit, you can use this form to claim Council Tax Support to help pay your Council Tax.

Council Tax refund application To receive a refund, please complete this form, I claim a refund of overpaid Council Tax and declare that I am/represent the

Refunds. You can ask for a Council Tax refund if you’ve paid too much Council Tax. Ask for a Council Tax refund If you want to ask for a refund for someone who’s died

Council Tax Indemnity Form – Council Tax – Form. Form to claim a refund due to a death or other reason someone cannot sign the refund form.

Claim for refund of Council Tax Account number Transformation & Finance Civic Centre Windmill Street Gravesend Kent DA12 1AU Telephone: 01474 33 77 00

Apply for a Council Tax refund City of Lincoln Council

Council Tax Refund Claim Form stalbans.gov.uk

In order to claim any credit on your Council Tax account please download and complete and return the PDF claim form

Please complete and return this form to: Callendar Square Centre, Falkirk, FK1 1UJ COUNCIL TAX EXEMPTION CLAIM FORM Property Undergoing Major Works

Council Tax Benefit, Backdated council tax benefit claim; Personal callers should visit their nearest One Stop Shop to hand in claim forms,

If you think you may be entitled to a refund on your council tax account, please complete a refund claim form. If your account is in credit and you are moving to

Council Tax Indemnity Form – Council Tax – Form. Form to claim a refund due to a death or other reason someone cannot sign the refund form.

About council tax Who must pay council tax Thurrock

Claim your Council Tax refund Lambeth Council

Housing benefit & council tax benefit reference (if you have claimed at Westminster before) • Fill in this form to claim help with your rent or council tax.

Question. There is a credit on my account, how do I get a refund? Answer. If your council tax account is in credit you can claim a refund. If you want to claim a

People Who Provide Care or Are Cared For Exemption; Council Tax Energy Efficiency Discount Scheme; Young People Leaving Care; Other Exemptions and Discounts;

Claim for refund of Council Tax Account number Transformation & Finance Civic Centre Windmill Street Gravesend Kent DA12 1AU Telephone: 01474 33 77 00

You can use this service to apply for a council tax refund.

‘Thousands’ owed council tax refunds after paying unnecessarily Contact your local council and request a claim form to register for a council tax discount.

How do I claim? To claim Council Tax Reduction you can simply fill in our online claim form.

Refunds The London Borough Of Havering

‘Thousands’ owed council tax refunds after paying

‘Thousands’ owed council tax refunds after paying unnecessarily Contact your local council and request a claim form to register for a council tax discount.

People Who Provide Care or Are Cared For Exemption; Council Tax Energy Efficiency Discount Scheme; Young People Leaving Care; Other Exemptions and Discounts;

Council tax refund. Council Tax Refund – Council Tax – Form -LIVE. Your details. Please enter the amount you would like to claim for a refund Cancel Next

My Account – council tax. Council tax forms. Council tax form – refund claim (DOC 354.50KB) My area. Go. My account Related. Paying your council tax;

You may be eligible for Council Tax Support (sometimes called Council Tax Reduction) if you’re on a low income or claim certain benefits.

Home > Claiming Back > Claiming Back Your Council Tax If in the wrong band can we claim a refund as the then got the form from the council to fill in

Considering home expenses for your tax return FreeAgent

Council tax Royal Borough of Kensington and Chelsea

Enter your postcode in the Council Tax Bands search box You can then fill in an online form which will be sent to you may be able to claim a council tax

Council Tax Refund Claim Form The Authority’s Council Tax records indicate your account to be in credit. To enable a refund to be made please complete this form.

Considering home expenses for your tax return. Emily Coltman. 27 January 2012 Jump to comments. Are you, You can claim a proportion of your council tax cost.

Council tax refund. Council Tax Refund – Council Tax – Form -LIVE. Your details. Please enter the amount you would like to claim for a refund Cancel Next

Council Tax refund application To receive a refund, please complete this form, I claim a refund of overpaid Council Tax and declare that I am/represent the

Regardless of whether you claim Universal Credit or Housing Benefit, you can use this form to claim Council Tax Support to help pay your Council Tax.

Ctax Refund. Please use this form to request a refund. Council Tax Account number (enter as 10 numbers with no spaces): * Is the refund on a

Council Tax Benefit, Backdated council tax benefit claim; Personal callers should visit their nearest One Stop Shop to hand in claim forms,

Backdated council tax benefit claim; and subsequently complete and return that form to the Benefits Service for council tax your council tax benefit must

Frequently asked questions about claiming housing benefit and council tax Search form. invisible have a mortgage are only able to claim Council Tax

Claim Form for Housing Benefit and/or Council Tax Reduction

About council tax Who must pay council tax Thurrock

This form should be completed if you have overpaid your council tax and would like to apply for a refund. The person completing this form must be one of those named

Considering home expenses for your tax return. Emily Coltman. 27 January 2012 Jump to comments. Are you, You can claim a proportion of your council tax cost.

You can use this service to apply for a council tax refund.

Return to council home. Request a council tax refund. The form cannot be displayed in the browser because the use of session cookies has been disabled in the

How to claim Council Tax Reduction Sandwell Council

Claim Form for Housing Benefit and/or Council Tax Reduction

Council Tax – Request a refund Introduction. Use this form to request a refund of overpaid Council Tax. Your refund will be paid directly into your bank account so

When you make a new claim for Housing Benefit and Council Tax Reduction we will normally only pay you from the Monday after we receive your completed claim form.

Council Tax refunds. If there is a credit on your Council Tax account, you can claim a refund to be paid directly into your bank account. Claim a Council Tax refund

Find Out How To Benefit This Financial Year From Your Tax Deductible Donations In Your Tax Return and Try Our Tax Calculator. or More Is Tax Deductible.

Use our quick and easy tax rebate calculator to see if you are entitled to a tax refund recover overpaid tax from HMRC. “Claim Form” refers to the signed

Download application forms in relation to council tax. Download council tax forms. You can download and complete the forms below and return them to the revenues

Council Tax billing and payment queries. Request a refund; How we collect unpaid Council Tax; you may be able to claim You can find more information on the

… were entitled to a full council tax refund due to council tax and you can claim any council tax back that the form back to the council with

Claim Form for Housing Benefit and/or Council Tax Reduction Tick √ as appropriate New claim Postal review Change of address Homeless cases

Enter your postcode in the Council Tax Bands search box You can then fill in an online form which will be sent to you may be able to claim a council tax

claim for Housing Benefit and Council Tax Support

A Claim for Housing Benefit and Council Tax Reduction

Question. There is a credit on my account, how do I get a refund? Answer. If your council tax account is in credit you can claim a refund. If you want to claim a

Download application forms in relation to council tax. Download council tax forms. You can download and complete the forms below and return them to the revenues

Housing benefit & council tax benefit reference (if you have claimed at Westminster before) • Fill in this form to claim help with your rent or council tax.

This form should be completed if you have overpaid your council tax and would like to apply for a refund. The person completing this form must be one of those named

Council Tax Refund Form. Disabled Reduction Application Form. Disabled Reduction Application Explanatory Notes. Person in Dentention Form (Prison)

My Account – council tax. Council tax forms. Council tax form – refund claim (DOC 354.50KB) My area. Go. My account Related. Paying your council tax;

Scam warning about Council Tax refunds. Residents have received calls that their property council tax band is wrong and have paid too much Birmingham City Council.

Council Tax – Request a refund Introduction. Use this form to request a refund of overpaid Council Tax. Your refund will be paid directly into your bank account so

I hereby claim a refund of overpaid Council Tax for the following reason:* (a) have provided on this form for the prevention and detection Council Tax Refund

Renting from the council or a housing association Debt and money Tax Tax refunds – claiming back overpaid tax. Find out how to claim a refund for overpaid tax.

You can use this service to apply for a council tax refund.

Council tax refund London Borough of Havering

Council tax refunds Barnsley

Council Tax refund application To receive a refund, please complete this form, I claim a refund of overpaid Council Tax and declare that I am/represent the

Form to request a refund on your council tax account. Request a refund on your council tax account. You can request a refund if your council tax account is in credit.

Apply for it; Find it; Info; Open data; Council tax – discount claim form; Council tax Nationality document return service;

If you have overpaid on your Council Tax you can request a refund here. Request a refund of overpaid Council Tax. iCM Form. Council tax details

Find Out How To Benefit This Financial Year From Your Tax Deductible Donations In Your Tax Return and Try Our Tax Calculator. or More Is Tax Deductible.

Some people affected by dementia are eligible for a discount on their council tax bill. We look at who needs to pay council tax, and the reductions, discounts and

Backdated council tax benefit claim; and subsequently complete and return that form to the Benefits Service for council tax your council tax benefit must

Considering home expenses for your tax return. Emily Coltman. 27 January 2012 Jump to comments. Are you, You can claim a proportion of your council tax cost.

Renting from the council or a housing association Debt and money Tax Tax refunds – claiming back overpaid tax. Find out how to claim a refund for overpaid tax.

Regardless of whether you claim Universal Credit or Housing Benefit, you can use this form to claim Council Tax Support to help pay your Council Tax.

Ctax Refund. Please use this form to request a refund. Council Tax Account number (enter as 10 numbers with no spaces): * Is the refund on a

If you think you may be entitled to a refund on your council tax account, please complete a refund claim form. If your account is in credit and you are moving to

Housing benefit & council tax benefit reference (if you have claimed at Westminster before) • Fill in this form to claim help with your rent or council tax.

Tax refunds claiming back overpaid tax – Citizens Advice

Backdating claims Newcastle City Council

Form to request a refund on your council tax account. Request a refund on your council tax account. You can request a refund if your council tax account is in credit.

Council Tax Indemnity Form – Council Tax – Form. Form to claim a refund due to a death or other reason someone cannot sign the refund form.

Considering home expenses for your tax return. Emily Coltman. 27 January 2012 Jump to comments. Are you, You can claim a proportion of your council tax cost.

Download application forms in relation to council tax. Download council tax forms. You can download and complete the forms below and return them to the revenues

Claim Form for Housing Benefit and/or Council Tax Reduction Tick √ as appropriate New claim Postal review Change of address Homeless cases

Some people affected by dementia are eligible for a discount on their council tax bill. We look at who needs to pay council tax, and the reductions, discounts and

You can use this service to apply for a council tax refund.

• Car Tax refund • Council Tax Rebate • Gift Aid • IHT Tax Rebate • NI Refund Do I need to complete Tax Claim Forms when leaving the UK?

Housing benefit & council tax benefit reference (if you have claimed at Westminster before) • Fill in this form to claim help with your rent or council tax.

Renting from the council or a housing association Debt and money Tax Tax refunds – claiming back overpaid tax. Find out how to claim a refund for overpaid tax.

Do not delay in submitting your completed form. Housing Benefit and or Council Tax Reduction and return to your claim you can claim Council Tax

Claim your Council Tax refund Lambeth Council

‘Thousands’ owed council tax refunds after paying

A change in your circumstances that results in an overpayment of Council Tax could entitle you to a Council Tax refund. Council Tax refund form Basildon

Council Tax Benefit, Backdated council tax benefit claim; Personal callers should visit their nearest One Stop Shop to hand in claim forms,

Claiming Council Tax Support On this page. you also make an online claim or return our short CTS claim form with one month of being invited to do so.

You can apply for a Council Tax refund, if you think you have overpaid and we owe you money. For example, apply for a refund if you have moved outside of Lambeth.

Regardless of whether you claim Universal Credit or Housing Benefit, you can use this form to claim Council Tax Support to help pay your Council Tax.

Do not delay in submitting your completed form. Housing Benefit and or Council Tax Reduction and return to your claim you can claim Council Tax

‘Thousands’ owed council tax refunds after paying unnecessarily Contact your local council and request a claim form to register for a council tax discount.

Claim Form for Housing Benefit and/or Council Tax Reduction Tick √ as appropriate New claim Postal review Change of address Homeless cases

Download application forms in relation to council tax. Download council tax forms. You can download and complete the forms below and return them to the revenues

Council Tax billing and payment queries. Request a refund; How we collect unpaid Council Tax; you may be able to claim You can find more information on the

‘Thousands’ owed council tax refunds after paying unnecessarily Contact your local council and request a claim form to register for a council tax discount.

Council tax general enquiry – barnet.gov.uk

Basildon Council Apply for a Council Tax Refund

You can apply for a Council Tax refund, if you think you have overpaid and we owe you money. For example, apply for a refund if you have moved outside of Lambeth.

Tax Deductible Donations Cancer Council NSW

Claim your Council Tax refund Lambeth Council

Thurrock Council Council Tax refund claim form

You can apply for a Council Tax refund, if you think you have overpaid and we owe you money. For example, apply for a refund if you have moved outside of Lambeth.

Apply for a Council Tax refund City of Lincoln Council

Swansea Request a Council Tax refund

‘Thousands’ owed council tax refunds after paying

A lot of information is available on the website which may answer your questions such as a Council tax banding query or setting up a direct debit for your payments.

Request a council tax refund Blackburn with Darwen Council

Find Out How To Benefit This Financial Year From Your Tax Deductible Donations In Your Tax Return and Try Our Tax Calculator. or More Is Tax Deductible.

claim for Housing Benefit and Council Tax Support

A change in your circumstances that results in an overpayment of Council Tax could entitle you to a Council Tax refund. Council Tax refund form Basildon

Council tax refunds Barnsley

You can use this form to claim a refund on any credit in your council tax account. Return form to: Thurrock Council, PO Box 1, Civic Offices, New Road, Grays, RM17 6SL

Council tax refunds Barnsley

Council tax indemnity London Borough of Havering

Council tax Royal Borough of Kensington and Chelsea

People Who Provide Care or Are Cared For Exemption; Council Tax Energy Efficiency Discount Scheme; Young People Leaving Care; Other Exemptions and Discounts;

Refunds Southwark Council

Council tax indemnity London Borough of Havering

Regardless of whether you claim Universal Credit or Housing Benefit, you can use this form to claim Council Tax Support to help pay your Council Tax.

St Albans City & District Council Council Tax refunds

Refunds Southwark Council

Ctax Refund. Please use this form to request a refund. Council Tax Account number (enter as 10 numbers with no spaces): * Is the refund on a

Request a council tax refund Blackburn with Darwen Council

Are you due a council tax refund? Martin Lewis reveals you

Claiming a refund of credit Benefits and Council Tax

Claim for refund of Council Tax Account number Transformation & Finance Civic Centre Windmill Street Gravesend Kent DA12 1AU Telephone: 01474 33 77 00

Council Tax Request a refund Southwark Council

Claiming Back Your Council Tax If You Have Overpaid

Council tax Royal Borough of Kensington and Chelsea

People Who Provide Care or Are Cared For Exemption; Council Tax Energy Efficiency Discount Scheme; Young People Leaving Care; Other Exemptions and Discounts;

Council tax Royal Borough of Kensington and Chelsea

Council Tax billing and payment queries · Enfield Council

Some people affected by dementia are eligible for a discount on their council tax bill. We look at who needs to pay council tax, and the reductions, discounts and

Council Tax Forms Corby Borough Council

A Claim for Housing Benefit and Council Tax and has a liability to pay rent and/or council tax Filling in the form to return home Yes

Backdating claims Newcastle City Council

Are you due a council tax refund? Martin Lewis reveals you

My Account – council tax. Council tax forms. Council tax form – refund claim (DOC 354.50KB) My area. Go. My account Related. Paying your council tax;

Claiming Back Your Council Tax If You Have Overpaid

… were entitled to a full council tax refund due to council tax and you can claim any council tax back that the form back to the council with

Council tax benefit/reduction entitlement Tower Hamlets

Claiming Back Your Council Tax If You Have Overpaid

Claim for Housing Benefit/Council Tax Support City of

Claim for refund of Council Tax Account number Transformation & Finance Civic Centre Windmill Street Gravesend Kent DA12 1AU Telephone: 01474 33 77 00

Council tax benefit/reduction overpayments Tower Hamlets

Tax refunds claiming back overpaid tax – Citizens Advice

How to claim Council Tax Reduction Sandwell Council

Council Tax Indemnity Form – Council Tax – Form. Form to claim a refund due to a death or other reason someone cannot sign the refund form.

Council Tax refund application City of Westminster

Thurrock Council Council Tax refund claim form

Swansea Request a Council Tax refund

Scam warning about Council Tax refunds. Residents have received calls that their property council tax band is wrong and have paid too much Birmingham City Council.

Council tax benefit/reduction entitlement Tower Hamlets

Request a refund on your council tax account Manchester

You can claim a Council Tax reduction if you meet all the following. savings of less than £16,000; responsible for paying the Council Tax bill; have a low income

Tax refunds claiming back overpaid tax – Citizens Advice

COUNCIL TAX EXEMPTION CLAIM FORM falkirk.gov.uk

• Car Tax refund • Council Tax Rebate • Gift Aid • IHT Tax Rebate • NI Refund Do I need to complete Tax Claim Forms when leaving the UK?

Council Tax Refund Application Slough Borough Council