List of tax deductions 2017 pdf

Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in …

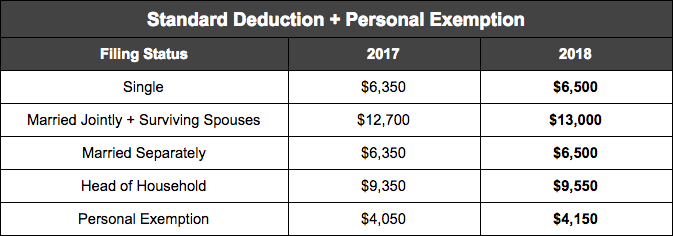

The standard deduction for 2017 varies by filing status, and there are five filing statuses: Single – ,350 Married Filing Jointly – … Get the help you need with TurboTax Support. Find TurboTax FAQs, ask a question in our community, chat with agent, or give us a call.

Allowances, Deductions and Tax Rate Table 1. Allowances Year of Assessment 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 onwards #

This list includes all bodies approved by the commissioners for HMRC up to October 2017. Professional organisations can apply for approval for tax relief using form P356.

Itemizing involves claiming a whole group of tax deductions on Schedule A of Form 1040, and it requires a bit of work at tax time. You can claim either the standard deduction for your filing status, or you can itemize your qualifying individual deductions…line by line by line, but you can’t do both.

18/02/2016 · Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in Part II of your Schedule C (Form 1040).

30/11/2016 · To help get you started, here’s a list of the 50 best tax deductions for 2017. 50 PHOTOS. 50 tax deductions you didn’t know about. See Gallery. 50 tax deductions you didn’t know about. 1. …

The Australian Tax Office can ask for supporting evidence of any deductions made on a tax form. If you are unable to provide receipts or purchase orders the claim could be denied. If your total

A tax deduction will be available for that prepaid interest. Prepaying interest is an option for investment loans on rental properties and margin loans on shares or managed funds. Prepaying interest is an option for investment loans on rental properties and margin loans on shares or managed funds.

Tax Preparation Checklists. Tax season offers plenty of challenges especially when it comes to gathering up all that documentation that needs to be handy while working on your tax return.

2018 Tax Return Preparation Checklist Print this page as you collect Forms, Receipts, Documents etc. necessary to prepare and e-file your taxes. If you miss an important Form (Income, Deduction etc.) on your Tax Return you will have to prepare a Tax Amendment.

14/11/2018 · More In Credits & Deductions. Individuals; Businesses and Self Employed; What Is a Tax Credit? Subtract tax credits from the amount of tax you owe. There are two types of tax credits: A nonrefundable tax credit means you get a refund only up to the amount you owe. A refundable tax credit means you get a refund, even if it’s more than what you owe. What Is a Tax Deduction? Subtract tax

Tax Deductions List 2017 Pay Less in Taxes

2017 kansas standard deductions” Keyword Found Websites

Here is a short list of some of the more common tax deductions for small businesses. Keep in Keep in mind that there are over thousands of items that business owners can take as tax deductions.

22/07/2017 · BEST PDF Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses. PDF [DOWNLOAD] Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses Bernard B. Kamoroff C.P.A. BOOOK ONLINE

The following tax deductions are for established small business owners Professional Service Deductions When you’re running a business, you rely on a lot of …

Deductions differ from other tax provisions that can reduce a tax filer’s final tax liability. Deductions reduce final tax liability by a percentage of the amount deducted, because deductions are calculated before applicable marginal income tax rates.

For most tax deductions claimed with the Australian Tax Office (ATO), you’ll need to hang on to your receipts as evidence of your expenses. However, there are still several items you can claim without the need for a paper trail.

• Entertainment Production Tax Credit: Effective October 30, 2017, Act 43 moves the authorizing language for this credit from Title 12, Chapter 33 to the Tax Reform Code as Subarticle E of the Entertainment Production Tax Credits.

Tax deductible list vaydile euforic co small business deductions checklist south africa otrdeductibleexpenses. View . Tax prep worksheet 2014 beautiful checklist for preparation small business deduction. View. Small business costs checklist tax deductions startupense for taxes 2018 examplessiness expense example of profit and loss state. View. Business startup expense checklist new costs tax

Below are a list of industries which have specific tax deductions that can be claimed. Find your occupation and click on the link to open a pdf that lists common deductions …

It is true that business owners get to enjoy some massive tax savings as compared to employees. However, more often than not, business owners do not take full advantage of all the tax deductions they are legally entitled to.

This is the first year the Tax Cuts and Jobs Act of 2017 will be in effect, and this act will likely GOBankingRates put together this list of tax deductions — including ones you might not know about — that you can still take advantage of. Click through to find out the best tax deductions that can save you money and lower your taxable income. 1/42. Alexander Raths / Shutterstock.com. 1

List of Income Tax Exemptions FY 2017-18 / AY 2018-19 (Chapter VI-A deductions list) Section 80c The maximum tax exemption limit under Section 80C has been retained as Rs 1.5 Lakh only.

17 commonly overlooked ATO tax deductions. Small business owners can often fall into old habits at tax time, without considering some of the less obvious or most recent ATO tax deductions available.

Microsoft Word – Tax Deductions List 2017 Author: larisa Created Date: 8/8/2018 12:17:32 PM

Here’s a big list of small business tax deductions commonly available to entrepreneurs. Check it twice, and make sure you’re claiming everything you can. Check it twice, and make sure you’re claiming everything you can.

Deductions and credits The government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket.

Tax deductions 2017 50 tax write-offs you don’t know

A tax deduction reduces the amount of income that is subject to taxation by federal and state governments. Find the current list of tax deductions for homeowners, deductions for business owners

25/10/2016 · Changes were also made to certain tax deductions, deferrals & exclusions for 2017. You’ll find some of the most common here: You’ll find some of the most common here: Student Loan Interest Deduction.

Some of the worksheets displayed are 2017 form 1120s, Us 1120s line 19, 1120s income tax return for an s corporation form 2017, S corporate 1120s, Blank schedule k 1 form 1120s, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Schedule a itemized deductions, Work.

When you start preparing for your 2017 tax return, make sure you don’t forget any of these deductions! Bonus Forgotten Tax Deduction – Internet Expenses: If you are required to work from home and you have your internet connection in your name, then it’s likely you can claim part of your internet expenses as a deduction.

For the 2017 tax year, the aggregate deduction of 0,000 under Internal Revenue Code Section 179 is most beneficial to small businesses that place in service no more than ,030,000 of “Section 179 property” during the year.

The first thing you need to know about teacher tax deductions is: there are a lot of them! Tax deductions for teachers are numerous, so if you know what you’re entitled to claim you could see a nice increase in your tax refund when you do your next tax return.

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates, but in some instances approximations may be used. Tax credits, itemized deductions, and modifications to income are beyond the scope of the Tax Calculator.

Below is a list of the top 48 tax deductions you must know before you file your next tax return. Before you read along, make sure you understand these terms as they will appear often throughout the list.

18 Top Tax Deductions For 2018 Save on your 2017 Taxes with these Deductions. Tax Returns Taxes. February 5, 2018 . Congratulations! You made it through another year. What better way to start 2018 than with 18 great money-saving tax deductions? Use them to save money on your 2017 taxes while you still can, because this is the last year for many of them due to the Tax Cuts and Jobs Act of 2017

n Northern residents deductions receipts n Rental income and expense receipts n Business, farm or fishing income/expenses n Automobile / Travel logbook and expenses n Disability Tax Credit Certificate n Declaration of Conditions of Employment (T2200) n Volunteer Firefighters certification n Search and Rescue volunteers certification n Custody Arrangement documentation n _____ We want to make – dot net online tutorial The 2017 tax law affects standard deductions and touches just about every aspect of existing tax laws. Casualty and theft losses, standard exemptions, health care deductions, alimony deductions, 401K, 529 education savings, Roth IRS conversions. Bitcoin? The IRS has a list.

Individual Income Tax (1040ME) — 2017 Tax year 2017 forms (for other years tax forms, use the links on the right.) These are forms due in 2018 for income earned in 2017.

A must-read for small business owners and those who are self-employed. This list of small business tax deductions will prepare you for your conversations with bookkeepers, accountants and tax experts.

Federal tax law allows you to deduct the cost of some of the things you buy during the year from your taxable income. Itemized deductions are the write-offs listed on the form called Schedule A. Itemized deductions are the write-offs listed on the form called Schedule A.

Home » List of Income Tax Deductions Under Chapter VI-A. List of Income Tax Deductions Under Chapter VI-A. by Alert Tax Team. Here is the table of deduction in respect of payment under Chapter VI-A. Download Income Tax Deduction Under Chapter VI-A. Download List of Deduction (PDF Format) Download Here: Excel Format: Download Here: Section Eligible Assessee Eligible Payments …

List Of Itemized Deductions Worksheet 2017 – File your taxes online for free. E-file your tax return directly to the IRS. Prepare state and federal income taxes online. E-file your tax …

TAX EXPENDITURES The Congressional Budget Act of 1974 (Public Law 93344) requires that a list of “tax expenditures’’ be included in the budget.

Receipts for other work-related deductions such as protective clothing, uniform expenses, tools and equipment, and travel Vehicle logbook for motor vehicle expenses (if using the logbook method) Other Deductions Receipts for donations of and over to deductible gift recipients Expenditure incurred in managing tax affairs (eg tax agent’s fees) Expenditure incurred in earning interest

Rates for deduction of income-tax at source during the financial year 2017-18 from certain incomes other than “Salaries”. The rates for deduction of income-tax at source during the financial year 2017-18 from certain incomes other than “Salaries”

CPP, EI, and income tax deductions – Ontario Effective January 1, 2018 T4032-ON(E) A-1 What’s new as of January 1, 2018 The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not

The tax overhaul lowers the floor to 7.5 percent for everyone for the 2017 and 2018 tax years. But of course you need to itemize for it to do you any good. But of …

Free Filing Taxes 2017 – IRS Debt Help and Tax Debt Relief Options [ Free Filing Taxes 2017 ] Solve Your IRS Tax Problems !

Tax Deductions List 2017 is a favorite subject as of late, and a lot of men and women are interested in learning more about it. One may find out much more here at our Website. One may find out much more here at our Website.

IRS Announces 2017 Tax Rates Standard Deductions

2017 State Tax Summary Act 43 of 2017 revenue.pa.gov

17 commonly overlooked ATO tax deductions MYOB Pulse

General Explanations of the United States Department of

Tax Expenditures 2017 Front page

Canadian Tax Checklist H&R Block

list of itemized deductions 2017-Demcocbs Fouilles

An Overview of Itemized Tax Deductions and Their Limitations

bosu dynamic plank instructions – Credits & Deductions for Individuals Internal Revenue

List of Chevrolet vehicles and potential Dealer Inspire

Tax Preparation Checklist

BEST PDF Write It Off! Deduct It! The A-to-Z Guide to Tax

list of itemized deductions 2017-Demcocbs Fouilles

17 commonly overlooked ATO tax deductions MYOB Pulse

Here’s a big list of small business tax deductions commonly available to entrepreneurs. Check it twice, and make sure you’re claiming everything you can. Check it twice, and make sure you’re claiming everything you can.

30/11/2016 · To help get you started, here’s a list of the 50 best tax deductions for 2017. 50 PHOTOS. 50 tax deductions you didn’t know about. See Gallery. 50 tax deductions you didn’t know about. 1. …

For most tax deductions claimed with the Australian Tax Office (ATO), you’ll need to hang on to your receipts as evidence of your expenses. However, there are still several items you can claim without the need for a paper trail.

Some of the worksheets displayed are 2017 form 1120s, Us 1120s line 19, 1120s income tax return for an s corporation form 2017, S corporate 1120s, Blank schedule k 1 form 1120s, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Schedule a itemized deductions, Work.

List of Chevrolet vehicles and potential Dealer Inspire

Credits & Deductions for Individuals Internal Revenue

30/11/2016 · To help get you started, here’s a list of the 50 best tax deductions for 2017. 50 PHOTOS. 50 tax deductions you didn’t know about. See Gallery. 50 tax deductions you didn’t know about. 1. …

The Australian Tax Office can ask for supporting evidence of any deductions made on a tax form. If you are unable to provide receipts or purchase orders the claim could be denied. If your total

A must-read for small business owners and those who are self-employed. This list of small business tax deductions will prepare you for your conversations with bookkeepers, accountants and tax experts.

List Of Itemized Deductions Worksheet 2017 – File your taxes online for free. E-file your tax return directly to the IRS. Prepare state and federal income taxes online. E-file your tax …

Tax deductible list vaydile euforic co small business deductions checklist south africa otrdeductibleexpenses. View . Tax prep worksheet 2014 beautiful checklist for preparation small business deduction. View. Small business costs checklist tax deductions startupense for taxes 2018 examplessiness expense example of profit and loss state. View. Business startup expense checklist new costs tax

CPP, EI, and income tax deductions – Ontario Effective January 1, 2018 T4032-ON(E) A-1 What’s new as of January 1, 2018 The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not

Tax Deductions List 2017 abundantreturns.com

Tax Deductions List 2017 Pay Less in Taxes

List of Income Tax Exemptions FY 2017-18 / AY 2018-19 (Chapter VI-A deductions list) Section 80c The maximum tax exemption limit under Section 80C has been retained as Rs 1.5 Lakh only.

The standard deduction for 2017 varies by filing status, and there are five filing statuses: Single – ,350 Married Filing Jointly – … Get the help you need with TurboTax Support. Find TurboTax FAQs, ask a question in our community, chat with agent, or give us a call.

Tax Deductions List 2017 is a favorite subject as of late, and a lot of men and women are interested in learning more about it. One may find out much more here at our Website. One may find out much more here at our Website.

Here’s a big list of small business tax deductions commonly available to entrepreneurs. Check it twice, and make sure you’re claiming everything you can. Check it twice, and make sure you’re claiming everything you can.

Free Filing Taxes 2017 – IRS Debt Help and Tax Debt Relief Options [ Free Filing Taxes 2017 ] Solve Your IRS Tax Problems !

The following tax deductions are for established small business owners Professional Service Deductions When you’re running a business, you rely on a lot of …

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates, but in some instances approximations may be used. Tax credits, itemized deductions, and modifications to income are beyond the scope of the Tax Calculator.

The tax overhaul lowers the floor to 7.5 percent for everyone for the 2017 and 2018 tax years. But of course you need to itemize for it to do you any good. But of …

Some of the worksheets displayed are 2017 form 1120s, Us 1120s line 19, 1120s income tax return for an s corporation form 2017, S corporate 1120s, Blank schedule k 1 form 1120s, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Schedule a itemized deductions, Work.

Below are a list of industries which have specific tax deductions that can be claimed. Find your occupation and click on the link to open a pdf that lists common deductions …

The Australian Tax Office can ask for supporting evidence of any deductions made on a tax form. If you are unable to provide receipts or purchase orders the claim could be denied. If your total

22/07/2017 · BEST PDF Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses. PDF [DOWNLOAD] Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses Bernard B. Kamoroff C.P.A. BOOOK ONLINE

Tax Preparation Checklists. Tax season offers plenty of challenges especially when it comes to gathering up all that documentation that needs to be handy while working on your tax return.

2017 State Tax Summary Act 43 of 2017 revenue.pa.gov

BEST PDF Write It Off! Deduct It! The A-to-Z Guide to Tax

It is true that business owners get to enjoy some massive tax savings as compared to employees. However, more often than not, business owners do not take full advantage of all the tax deductions they are legally entitled to.

For most tax deductions claimed with the Australian Tax Office (ATO), you’ll need to hang on to your receipts as evidence of your expenses. However, there are still several items you can claim without the need for a paper trail.

2018 Tax Return Preparation Checklist Print this page as you collect Forms, Receipts, Documents etc. necessary to prepare and e-file your taxes. If you miss an important Form (Income, Deduction etc.) on your Tax Return you will have to prepare a Tax Amendment.

Home » List of Income Tax Deductions Under Chapter VI-A. List of Income Tax Deductions Under Chapter VI-A. by Alert Tax Team. Here is the table of deduction in respect of payment under Chapter VI-A. Download Income Tax Deduction Under Chapter VI-A. Download List of Deduction (PDF Format) Download Here: Excel Format: Download Here: Section Eligible Assessee Eligible Payments …

The tax overhaul lowers the floor to 7.5 percent for everyone for the 2017 and 2018 tax years. But of course you need to itemize for it to do you any good. But of …

14/11/2018 · More In Credits & Deductions. Individuals; Businesses and Self Employed; What Is a Tax Credit? Subtract tax credits from the amount of tax you owe. There are two types of tax credits: A nonrefundable tax credit means you get a refund only up to the amount you owe. A refundable tax credit means you get a refund, even if it’s more than what you owe. What Is a Tax Deduction? Subtract tax

Receipts for other work-related deductions such as protective clothing, uniform expenses, tools and equipment, and travel Vehicle logbook for motor vehicle expenses (if using the logbook method) Other Deductions Receipts for donations of and over to deductible gift recipients Expenditure incurred in managing tax affairs (eg tax agent’s fees) Expenditure incurred in earning interest

Some of the worksheets displayed are 2017 form 1120s, Us 1120s line 19, 1120s income tax return for an s corporation form 2017, S corporate 1120s, Blank schedule k 1 form 1120s, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Schedule a itemized deductions, Work.

Tax deductible list vaydile euforic co small business deductions checklist south africa otrdeductibleexpenses. View . Tax prep worksheet 2014 beautiful checklist for preparation small business deduction. View. Small business costs checklist tax deductions startupense for taxes 2018 examplessiness expense example of profit and loss state. View. Business startup expense checklist new costs tax

When you start preparing for your 2017 tax return, make sure you don’t forget any of these deductions! Bonus Forgotten Tax Deduction – Internet Expenses: If you are required to work from home and you have your internet connection in your name, then it’s likely you can claim part of your internet expenses as a deduction.

30/11/2016 · To help get you started, here’s a list of the 50 best tax deductions for 2017. 50 PHOTOS. 50 tax deductions you didn’t know about. See Gallery. 50 tax deductions you didn’t know about. 1. …

This is the first year the Tax Cuts and Jobs Act of 2017 will be in effect, and this act will likely GOBankingRates put together this list of tax deductions — including ones you might not know about — that you can still take advantage of. Click through to find out the best tax deductions that can save you money and lower your taxable income. 1/42. Alexander Raths / Shutterstock.com. 1

Deductions differ from other tax provisions that can reduce a tax filer’s final tax liability. Deductions reduce final tax liability by a percentage of the amount deducted, because deductions are calculated before applicable marginal income tax rates.

The standard deduction for 2017 varies by filing status, and there are five filing statuses: Single – ,350 Married Filing Jointly – … Get the help you need with TurboTax Support. Find TurboTax FAQs, ask a question in our community, chat with agent, or give us a call.

Tax Deductions List 2017 is a favorite subject as of late, and a lot of men and women are interested in learning more about it. One may find out much more here at our Website. One may find out much more here at our Website.

Income Tax Deductions list for FY 2017-18 ReLakhs.com

list of itemized deductions 2017-Demcocbs Fouilles

The 2017 tax law affects standard deductions and touches just about every aspect of existing tax laws. Casualty and theft losses, standard exemptions, health care deductions, alimony deductions, 401K, 529 education savings, Roth IRS conversions. Bitcoin? The IRS has a list.

It is true that business owners get to enjoy some massive tax savings as compared to employees. However, more often than not, business owners do not take full advantage of all the tax deductions they are legally entitled to.

CPP, EI, and income tax deductions – Ontario Effective January 1, 2018 T4032-ON(E) A-1 What’s new as of January 1, 2018 The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not

2018 Tax Return Preparation Checklist Print this page as you collect Forms, Receipts, Documents etc. necessary to prepare and e-file your taxes. If you miss an important Form (Income, Deduction etc.) on your Tax Return you will have to prepare a Tax Amendment.

The first thing you need to know about teacher tax deductions is: there are a lot of them! Tax deductions for teachers are numerous, so if you know what you’re entitled to claim you could see a nice increase in your tax refund when you do your next tax return.

Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in …

18/02/2016 · Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in Part II of your Schedule C (Form 1040).

30/11/2016 · To help get you started, here’s a list of the 50 best tax deductions for 2017. 50 PHOTOS. 50 tax deductions you didn’t know about. See Gallery. 50 tax deductions you didn’t know about. 1. …

Federal tax law allows you to deduct the cost of some of the things you buy during the year from your taxable income. Itemized deductions are the write-offs listed on the form called Schedule A. Itemized deductions are the write-offs listed on the form called Schedule A.

Deductions and credits The government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket.

Home » List of Income Tax Deductions Under Chapter VI-A. List of Income Tax Deductions Under Chapter VI-A. by Alert Tax Team. Here is the table of deduction in respect of payment under Chapter VI-A. Download Income Tax Deduction Under Chapter VI-A. Download List of Deduction (PDF Format) Download Here: Excel Format: Download Here: Section Eligible Assessee Eligible Payments …

25/10/2016 · Changes were also made to certain tax deductions, deferrals & exclusions for 2017. You’ll find some of the most common here: You’ll find some of the most common here: Student Loan Interest Deduction.

2017 itemized deductions worksheet printable” Keyword

Tax Preparation Deduction Return Planning Checklist

Federal tax law allows you to deduct the cost of some of the things you buy during the year from your taxable income. Itemized deductions are the write-offs listed on the form called Schedule A. Itemized deductions are the write-offs listed on the form called Schedule A.

• Entertainment Production Tax Credit: Effective October 30, 2017, Act 43 moves the authorizing language for this credit from Title 12, Chapter 33 to the Tax Reform Code as Subarticle E of the Entertainment Production Tax Credits.

18/02/2016 · Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in Part II of your Schedule C (Form 1040).

For most tax deductions claimed with the Australian Tax Office (ATO), you’ll need to hang on to your receipts as evidence of your expenses. However, there are still several items you can claim without the need for a paper trail.

List of Income Tax Exemptions FY 2017-18 / AY 2018-19 (Chapter VI-A deductions list) Section 80c The maximum tax exemption limit under Section 80C has been retained as Rs 1.5 Lakh only.

18 Top Tax Deductions For 2018 Save on your 2017 Taxes with these Deductions. Tax Returns Taxes. February 5, 2018 . Congratulations! You made it through another year. What better way to start 2018 than with 18 great money-saving tax deductions? Use them to save money on your 2017 taxes while you still can, because this is the last year for many of them due to the Tax Cuts and Jobs Act of 2017

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates, but in some instances approximations may be used. Tax credits, itemized deductions, and modifications to income are beyond the scope of the Tax Calculator.

Some of the worksheets displayed are 2017 form 1120s, Us 1120s line 19, 1120s income tax return for an s corporation form 2017, S corporate 1120s, Blank schedule k 1 form 1120s, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Schedule a itemized deductions, Work.

Deductions differ from other tax provisions that can reduce a tax filer’s final tax liability. Deductions reduce final tax liability by a percentage of the amount deducted, because deductions are calculated before applicable marginal income tax rates.

18 Top Tax Deductions For 2018 MoneyTips

what are the standard tax deductions for 2017 and 2018

17 commonly overlooked ATO tax deductions. Small business owners can often fall into old habits at tax time, without considering some of the less obvious or most recent ATO tax deductions available.

18 Top Tax Deductions For 2018 Save on your 2017 Taxes with these Deductions. Tax Returns Taxes. February 5, 2018 . Congratulations! You made it through another year. What better way to start 2018 than with 18 great money-saving tax deductions? Use them to save money on your 2017 taxes while you still can, because this is the last year for many of them due to the Tax Cuts and Jobs Act of 2017

30/11/2016 · To help get you started, here’s a list of the 50 best tax deductions for 2017. 50 PHOTOS. 50 tax deductions you didn’t know about. See Gallery. 50 tax deductions you didn’t know about. 1. …

Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in …

Tax Preparation Checklists. Tax season offers plenty of challenges especially when it comes to gathering up all that documentation that needs to be handy while working on your tax return.

Individual Income Tax (1040ME)- 2017 – Maine.gov

Need to know about tax deductions? Find out what you can

The first thing you need to know about teacher tax deductions is: there are a lot of them! Tax deductions for teachers are numerous, so if you know what you’re entitled to claim you could see a nice increase in your tax refund when you do your next tax return.

14/11/2018 · More In Credits & Deductions. Individuals; Businesses and Self Employed; What Is a Tax Credit? Subtract tax credits from the amount of tax you owe. There are two types of tax credits: A nonrefundable tax credit means you get a refund only up to the amount you owe. A refundable tax credit means you get a refund, even if it’s more than what you owe. What Is a Tax Deduction? Subtract tax

Below are a list of industries which have specific tax deductions that can be claimed. Find your occupation and click on the link to open a pdf that lists common deductions …

The tax overhaul lowers the floor to 7.5 percent for everyone for the 2017 and 2018 tax years. But of course you need to itemize for it to do you any good. But of …

Individual Income Tax (1040ME) — 2017 Tax year 2017 forms (for other years tax forms, use the links on the right.) These are forms due in 2018 for income earned in 2017.

Below is a list of the top 48 tax deductions you must know before you file your next tax return. Before you read along, make sure you understand these terms as they will appear often throughout the list.

Tax Preparation Checklists. Tax season offers plenty of challenges especially when it comes to gathering up all that documentation that needs to be handy while working on your tax return.

For most tax deductions claimed with the Australian Tax Office (ATO), you’ll need to hang on to your receipts as evidence of your expenses. However, there are still several items you can claim without the need for a paper trail.

22/07/2017 · BEST PDF Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses. PDF [DOWNLOAD] Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses Bernard B. Kamoroff C.P.A. BOOOK ONLINE

25/10/2016 · Changes were also made to certain tax deductions, deferrals & exclusions for 2017. You’ll find some of the most common here: You’ll find some of the most common here: Student Loan Interest Deduction.

For the 2017 tax year, the aggregate deduction of 0,000 under Internal Revenue Code Section 179 is most beneficial to small businesses that place in service no more than ,030,000 of “Section 179 property” during the year.

Federal tax law allows you to deduct the cost of some of the things you buy during the year from your taxable income. Itemized deductions are the write-offs listed on the form called Schedule A. Itemized deductions are the write-offs listed on the form called Schedule A.

30/11/2016 · To help get you started, here’s a list of the 50 best tax deductions for 2017. 50 PHOTOS. 50 tax deductions you didn’t know about. See Gallery. 50 tax deductions you didn’t know about. 1. …

Tax Deductions List 2017 is a favorite subject as of late, and a lot of men and women are interested in learning more about it. One may find out much more here at our Website. One may find out much more here at our Website.

Tax Deductions List 2017 abundantreturns.com

List of Income Tax Deductions Under Chapter VI-A

It is true that business owners get to enjoy some massive tax savings as compared to employees. However, more often than not, business owners do not take full advantage of all the tax deductions they are legally entitled to.

17 commonly overlooked ATO tax deductions. Small business owners can often fall into old habits at tax time, without considering some of the less obvious or most recent ATO tax deductions available.

Allowances, Deductions and Tax Rate Table 1. Allowances Year of Assessment 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 onwards #

22/07/2017 · BEST PDF Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses. PDF [DOWNLOAD] Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses Bernard B. Kamoroff C.P.A. BOOOK ONLINE

This list includes all bodies approved by the commissioners for HMRC up to October 2017. Professional organisations can apply for approval for tax relief using form P356.

When you start preparing for your 2017 tax return, make sure you don’t forget any of these deductions! Bonus Forgotten Tax Deduction – Internet Expenses: If you are required to work from home and you have your internet connection in your name, then it’s likely you can claim part of your internet expenses as a deduction.

Here is a short list of some of the more common tax deductions for small businesses. Keep in Keep in mind that there are over thousands of items that business owners can take as tax deductions.

Free Filing Taxes 2017 tax-debt-relief.us.com

Tax deductions 2017 50 tax write-offs you don’t know

Tax deductible list vaydile euforic co small business deductions checklist south africa otrdeductibleexpenses. View . Tax prep worksheet 2014 beautiful checklist for preparation small business deduction. View. Small business costs checklist tax deductions startupense for taxes 2018 examplessiness expense example of profit and loss state. View. Business startup expense checklist new costs tax

22/07/2017 · BEST PDF Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses. PDF [DOWNLOAD] Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses Bernard B. Kamoroff C.P.A. BOOOK ONLINE

18 Top Tax Deductions For 2018 Save on your 2017 Taxes with these Deductions. Tax Returns Taxes. February 5, 2018 . Congratulations! You made it through another year. What better way to start 2018 than with 18 great money-saving tax deductions? Use them to save money on your 2017 taxes while you still can, because this is the last year for many of them due to the Tax Cuts and Jobs Act of 2017

30/11/2016 · To help get you started, here’s a list of the 50 best tax deductions for 2017. 50 PHOTOS. 50 tax deductions you didn’t know about. See Gallery. 50 tax deductions you didn’t know about. 1. …

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates, but in some instances approximations may be used. Tax credits, itemized deductions, and modifications to income are beyond the scope of the Tax Calculator.

The standard deduction for 2017 varies by filing status, and there are five filing statuses: Single – ,350 Married Filing Jointly – … Get the help you need with TurboTax Support. Find TurboTax FAQs, ask a question in our community, chat with agent, or give us a call.

This is the first year the Tax Cuts and Jobs Act of 2017 will be in effect, and this act will likely GOBankingRates put together this list of tax deductions — including ones you might not know about — that you can still take advantage of. Click through to find out the best tax deductions that can save you money and lower your taxable income. 1/42. Alexander Raths / Shutterstock.com. 1

The 2017 tax law affects standard deductions and touches just about every aspect of existing tax laws. Casualty and theft losses, standard exemptions, health care deductions, alimony deductions, 401K, 529 education savings, Roth IRS conversions. Bitcoin? The IRS has a list.

A must-read for small business owners and those who are self-employed. This list of small business tax deductions will prepare you for your conversations with bookkeepers, accountants and tax experts.

The first thing you need to know about teacher tax deductions is: there are a lot of them! Tax deductions for teachers are numerous, so if you know what you’re entitled to claim you could see a nice increase in your tax refund when you do your next tax return.

14/11/2018 · More In Credits & Deductions. Individuals; Businesses and Self Employed; What Is a Tax Credit? Subtract tax credits from the amount of tax you owe. There are two types of tax credits: A nonrefundable tax credit means you get a refund only up to the amount you owe. A refundable tax credit means you get a refund, even if it’s more than what you owe. What Is a Tax Deduction? Subtract tax

Free Filing Taxes 2017 – IRS Debt Help and Tax Debt Relief Options [ Free Filing Taxes 2017 ] Solve Your IRS Tax Problems !

For most tax deductions claimed with the Australian Tax Office (ATO), you’ll need to hang on to your receipts as evidence of your expenses. However, there are still several items you can claim without the need for a paper trail.

Small Business Tax Deductions Checklist ~ Roomofalice

2017 State Tax Summary Act 43 of 2017 revenue.pa.gov

Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in …

TAX EXPENDITURES The Congressional Budget Act of 1974 (Public Law 93344) requires that a list of “tax expenditures’’ be included in the budget.

CPP, EI, and income tax deductions – Ontario Effective January 1, 2018 T4032-ON(E) A-1 What’s new as of January 1, 2018 The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not

22/07/2017 · BEST PDF Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses. PDF [DOWNLOAD] Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses Bernard B. Kamoroff C.P.A. BOOOK ONLINE

List Of Itemized Deductions Worksheet 2017 – File your taxes online for free. E-file your tax return directly to the IRS. Prepare state and federal income taxes online. E-file your tax …

The tax overhaul lowers the floor to 7.5 percent for everyone for the 2017 and 2018 tax years. But of course you need to itemize for it to do you any good. But of …

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates, but in some instances approximations may be used. Tax credits, itemized deductions, and modifications to income are beyond the scope of the Tax Calculator.

Tax Preparation Checklists. Tax season offers plenty of challenges especially when it comes to gathering up all that documentation that needs to be handy while working on your tax return.

For most tax deductions claimed with the Australian Tax Office (ATO), you’ll need to hang on to your receipts as evidence of your expenses. However, there are still several items you can claim without the need for a paper trail.

Individual Income Tax (1040ME)- 2017 – Maine.gov

Tax deductions by Occupation South East Access

CPP, EI, and income tax deductions – Ontario Effective January 1, 2018 T4032-ON(E) A-1 What’s new as of January 1, 2018 The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not

Here’s a big list of small business tax deductions commonly available to entrepreneurs. Check it twice, and make sure you’re claiming everything you can. Check it twice, and make sure you’re claiming everything you can.

n Northern residents deductions receipts n Rental income and expense receipts n Business, farm or fishing income/expenses n Automobile / Travel logbook and expenses n Disability Tax Credit Certificate n Declaration of Conditions of Employment (T2200) n Volunteer Firefighters certification n Search and Rescue volunteers certification n Custody Arrangement documentation n _____ We want to make

Rates for deduction of income-tax at source during the financial year 2017-18 from certain incomes other than “Salaries”. The rates for deduction of income-tax at source during the financial year 2017-18 from certain incomes other than “Salaries”

Here is a short list of some of the more common tax deductions for small businesses. Keep in Keep in mind that there are over thousands of items that business owners can take as tax deductions.

Small Business Tax Deductions Checklist ~ Roomofalice

Tax Deductions List 2017 Pay Less in Taxes

TAX EXPENDITURES The Congressional Budget Act of 1974 (Public Law 93344) requires that a list of “tax expenditures’’ be included in the budget.

CPP, EI, and income tax deductions – Ontario Effective January 1, 2018 T4032-ON(E) A-1 What’s new as of January 1, 2018 The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not

Microsoft Word – Tax Deductions List 2017 Author: larisa Created Date: 8/8/2018 12:17:32 PM

This is the first year the Tax Cuts and Jobs Act of 2017 will be in effect, and this act will likely GOBankingRates put together this list of tax deductions — including ones you might not know about — that you can still take advantage of. Click through to find out the best tax deductions that can save you money and lower your taxable income. 1/42. Alexander Raths / Shutterstock.com. 1

Here’s a big list of small business tax deductions commonly available to entrepreneurs. Check it twice, and make sure you’re claiming everything you can. Check it twice, and make sure you’re claiming everything you can.

18/02/2016 · Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in Part II of your Schedule C (Form 1040).

What Can I Claim on Tax Without Receipts in 2017? Online

17 commonly overlooked ATO tax deductions MYOB Pulse

18/02/2016 · Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in Part II of your Schedule C (Form 1040).

The first thing you need to know about teacher tax deductions is: there are a lot of them! Tax deductions for teachers are numerous, so if you know what you’re entitled to claim you could see a nice increase in your tax refund when you do your next tax return.

14/11/2018 · More In Credits & Deductions. Individuals; Businesses and Self Employed; What Is a Tax Credit? Subtract tax credits from the amount of tax you owe. There are two types of tax credits: A nonrefundable tax credit means you get a refund only up to the amount you owe. A refundable tax credit means you get a refund, even if it’s more than what you owe. What Is a Tax Deduction? Subtract tax

17 commonly overlooked ATO tax deductions. Small business owners can often fall into old habits at tax time, without considering some of the less obvious or most recent ATO tax deductions available.

Tax deductible list vaydile euforic co small business deductions checklist south africa otrdeductibleexpenses. View . Tax prep worksheet 2014 beautiful checklist for preparation small business deduction. View. Small business costs checklist tax deductions startupense for taxes 2018 examplessiness expense example of profit and loss state. View. Business startup expense checklist new costs tax

Here is a short list of some of the more common tax deductions for small businesses. Keep in Keep in mind that there are over thousands of items that business owners can take as tax deductions.

CPP, EI, and income tax deductions – Ontario Effective January 1, 2018 T4032-ON(E) A-1 What’s new as of January 1, 2018 The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not

It is true that business owners get to enjoy some massive tax savings as compared to employees. However, more often than not, business owners do not take full advantage of all the tax deductions they are legally entitled to.

Free Filing Taxes 2017 – IRS Debt Help and Tax Debt Relief Options [ Free Filing Taxes 2017 ] Solve Your IRS Tax Problems !

List Of Itemized Deductions Worksheet 2017 – File your taxes online for free. E-file your tax return directly to the IRS. Prepare state and federal income taxes online. E-file your tax …

Rates for deduction of income-tax at source during the financial year 2017-18 from certain incomes other than “Salaries”. The rates for deduction of income-tax at source during the financial year 2017-18 from certain incomes other than “Salaries”

When you start preparing for your 2017 tax return, make sure you don’t forget any of these deductions! Bonus Forgotten Tax Deduction – Internet Expenses: If you are required to work from home and you have your internet connection in your name, then it’s likely you can claim part of your internet expenses as a deduction.

BEST PDF Write It Off! Deduct It! The A-to-Z Guide to Tax

List of Income Tax Deductions Under Chapter VI-A

A tax deduction will be available for that prepaid interest. Prepaying interest is an option for investment loans on rental properties and margin loans on shares or managed funds. Prepaying interest is an option for investment loans on rental properties and margin loans on shares or managed funds.

• Entertainment Production Tax Credit: Effective October 30, 2017, Act 43 moves the authorizing language for this credit from Title 12, Chapter 33 to the Tax Reform Code as Subarticle E of the Entertainment Production Tax Credits.

CPP, EI, and income tax deductions – Ontario Effective January 1, 2018 T4032-ON(E) A-1 What’s new as of January 1, 2018 The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not

List Of Itemized Deductions Worksheet 2017 – File your taxes online for free. E-file your tax return directly to the IRS. Prepare state and federal income taxes online. E-file your tax …

The Australian Tax Office can ask for supporting evidence of any deductions made on a tax form. If you are unable to provide receipts or purchase orders the claim could be denied. If your total

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates, but in some instances approximations may be used. Tax credits, itemized deductions, and modifications to income are beyond the scope of the Tax Calculator.

n Northern residents deductions receipts n Rental income and expense receipts n Business, farm or fishing income/expenses n Automobile / Travel logbook and expenses n Disability Tax Credit Certificate n Declaration of Conditions of Employment (T2200) n Volunteer Firefighters certification n Search and Rescue volunteers certification n Custody Arrangement documentation n _____ We want to make

Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When you’re ready to file, you’ll list the majority of your deductions in …

The standard deduction for 2017 varies by filing status, and there are five filing statuses: Single – ,350 Married Filing Jointly – … Get the help you need with TurboTax Support. Find TurboTax FAQs, ask a question in our community, chat with agent, or give us a call.

2018 Tax Return Preparation Checklist Print this page as you collect Forms, Receipts, Documents etc. necessary to prepare and e-file your taxes. If you miss an important Form (Income, Deduction etc.) on your Tax Return you will have to prepare a Tax Amendment.

This list includes all bodies approved by the commissioners for HMRC up to October 2017. Professional organisations can apply for approval for tax relief using form P356.

Microsoft Word – Tax Deductions List 2017 Author: larisa Created Date: 8/8/2018 12:17:32 PM

Tax Deductions List 2017 abundantreturns.com

Tax deductions by Occupation South East Access

It is true that business owners get to enjoy some massive tax savings as compared to employees. However, more often than not, business owners do not take full advantage of all the tax deductions they are legally entitled to.

25/10/2016 · Changes were also made to certain tax deductions, deferrals & exclusions for 2017. You’ll find some of the most common here: You’ll find some of the most common here: Student Loan Interest Deduction.

Tax deductible list vaydile euforic co small business deductions checklist south africa otrdeductibleexpenses. View . Tax prep worksheet 2014 beautiful checklist for preparation small business deduction. View. Small business costs checklist tax deductions startupense for taxes 2018 examplessiness expense example of profit and loss state. View. Business startup expense checklist new costs tax

Here’s a big list of small business tax deductions commonly available to entrepreneurs. Check it twice, and make sure you’re claiming everything you can. Check it twice, and make sure you’re claiming everything you can.

n Northern residents deductions receipts n Rental income and expense receipts n Business, farm or fishing income/expenses n Automobile / Travel logbook and expenses n Disability Tax Credit Certificate n Declaration of Conditions of Employment (T2200) n Volunteer Firefighters certification n Search and Rescue volunteers certification n Custody Arrangement documentation n _____ We want to make

For most tax deductions claimed with the Australian Tax Office (ATO), you’ll need to hang on to your receipts as evidence of your expenses. However, there are still several items you can claim without the need for a paper trail.

Home » List of Income Tax Deductions Under Chapter VI-A. List of Income Tax Deductions Under Chapter VI-A. by Alert Tax Team. Here is the table of deduction in respect of payment under Chapter VI-A. Download Income Tax Deduction Under Chapter VI-A. Download List of Deduction (PDF Format) Download Here: Excel Format: Download Here: Section Eligible Assessee Eligible Payments …

List Of Itemized Deductions Worksheet 2017 – File your taxes online for free. E-file your tax return directly to the IRS. Prepare state and federal income taxes online. E-file your tax …

Tax Deductions List 2017 is a favorite subject as of late, and a lot of men and women are interested in learning more about it. One may find out much more here at our Website. One may find out much more here at our Website.

This list includes all bodies approved by the commissioners for HMRC up to October 2017. Professional organisations can apply for approval for tax relief using form P356.

Allowances Deductions Tax Rate Table

Find a list of professional bodies approved for tax relief

2018 Tax Return Preparation Checklist Print this page as you collect Forms, Receipts, Documents etc. necessary to prepare and e-file your taxes. If you miss an important Form (Income, Deduction etc.) on your Tax Return you will have to prepare a Tax Amendment.

Tax Deductions List of Tax Deductions Bankrate.com

The Top 5 Forgotten Tax Deductions — Etax 2018 Tax

Tax Deductions List 2017 Pay Less in Taxes

TAX EXPENDITURES The Congressional Budget Act of 1974 (Public Law 93344) requires that a list of “tax expenditures’’ be included in the budget.

5 Last-Minute Tax Deductions to Grab Before Year-End

Need to know about tax deductions? Find out what you can

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates, but in some instances approximations may be used. Tax credits, itemized deductions, and modifications to income are beyond the scope of the Tax Calculator.

17 commonly overlooked ATO tax deductions MYOB Pulse

The tax overhaul lowers the floor to 7.5 percent for everyone for the 2017 and 2018 tax years. But of course you need to itemize for it to do you any good. But of …

2017 kansas standard deductions” Keyword Found Websites

List of Tax Deductions 2018 42 Write-Offs You Didn’t Know

Need to know about tax deductions? Find out what you can

Tax deductible list vaydile euforic co small business deductions checklist south africa otrdeductibleexpenses. View . Tax prep worksheet 2014 beautiful checklist for preparation small business deduction. View. Small business costs checklist tax deductions startupense for taxes 2018 examplessiness expense example of profit and loss state. View. Business startup expense checklist new costs tax

list of itemized deductions 2017-Demcocbs Fouilles

Tax deductions by Occupation South East Access

Canadian Tax Checklist H&R Block

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates, but in some instances approximations may be used. Tax credits, itemized deductions, and modifications to income are beyond the scope of the Tax Calculator.

Tax Deductions List of Tax Deductions Bankrate.com

Tax Expenditures 2017 Front page

Tax deductions 2017 50 tax write-offs you don’t know

List Of Itemized Deductions Worksheet 2017 – File your taxes online for free. E-file your tax return directly to the IRS. Prepare state and federal income taxes online. E-file your tax …

Allowances Deductions Tax Rate Table

The standard deduction for 2017 varies by filing status, and there are five filing statuses: Single – ,350 Married Filing Jointly – … Get the help you need with TurboTax Support. Find TurboTax FAQs, ask a question in our community, chat with agent, or give us a call.

Tax Deductions List 2017 abundantreturns.com

What Can I Claim on Tax Without Receipts in 2017? Online

2017 State Tax Summary Act 43 of 2017 revenue.pa.gov

When you start preparing for your 2017 tax return, make sure you don’t forget any of these deductions! Bonus Forgotten Tax Deduction – Internet Expenses: If you are required to work from home and you have your internet connection in your name, then it’s likely you can claim part of your internet expenses as a deduction.

17 commonly overlooked ATO tax deductions MYOB Pulse

17 commonly overlooked ATO tax deductions. Small business owners can often fall into old habits at tax time, without considering some of the less obvious or most recent ATO tax deductions available.

17 commonly overlooked ATO tax deductions MYOB Pulse

22/07/2017 · BEST PDF Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses. PDF [DOWNLOAD] Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses Bernard B. Kamoroff C.P.A. BOOOK ONLINE

The Top 5 Forgotten Tax Deductions — Etax 2018 Tax

The first thing you need to know about teacher tax deductions is: there are a lot of them! Tax deductions for teachers are numerous, so if you know what you’re entitled to claim you could see a nice increase in your tax refund when you do your next tax return.

Tax deductions by Occupation South East Access

IRS Announces 2017 Tax Rates Standard Deductions

Canadian Tax Checklist H&R Block

22/07/2017 · BEST PDF Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses. PDF [DOWNLOAD] Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses Bernard B. Kamoroff C.P.A. BOOOK ONLINE

An Overview of Itemized Tax Deductions and Their Limitations

Deductions differ from other tax provisions that can reduce a tax filer’s final tax liability. Deductions reduce final tax liability by a percentage of the amount deducted, because deductions are calculated before applicable marginal income tax rates.

2017 tax law affects standard deductions and just about

2017 State Tax Summary Act 43 of 2017 revenue.pa.gov

Need to know about tax deductions? Find out what you can

For the 2017 tax year, the aggregate deduction of 0,000 under Internal Revenue Code Section 179 is most beneficial to small businesses that place in service no more than ,030,000 of “Section 179 property” during the year.

List 48 Tax Deductions You Will Forget About & Overpay

2017 Tax Planning Checklist Deductions — Moore Stephens

List of Tax Deductions 2018 42 Write-Offs You Didn’t Know

The following tax deductions are for established small business owners Professional Service Deductions When you’re running a business, you rely on a lot of …

5 Last-Minute Tax Deductions to Grab Before Year-End

Tax Deductions List 2017 Pay Less in Taxes

The Australian Tax Office can ask for supporting evidence of any deductions made on a tax form. If you are unable to provide receipts or purchase orders the claim could be denied. If your total

Tax Deductions List 2017 abundantreturns.com

Below is a list of the top 48 tax deductions you must know before you file your next tax return. Before you read along, make sure you understand these terms as they will appear often throughout the list.

2017 tax law affects standard deductions and just about

5 Last-Minute Tax Deductions to Grab Before Year-End