The federal reserve and the financial crisis pdf

OR38WWTRBY3R » PDF » The Federal Reserve and the Financial Crisis Read Doc THE FEDERAL RESERVE AND THE FINANCIAL CRISIS Download PDF The Federal Reserve and the Financial

The Financial Crisis and the Federal Reserve by Frederic S. Mishkin* Graduate School of Business, Columbia University and National Bureau of Economic Research

testimony, “Lessons Learned from the Financial Crisis for Federal Reserve Policy,” will reconsider the Fed’s performance in meeting its mandates in the 2008-9 financial crisis and resulting Great

The Federal Reserve and the Financial Crisis Book by Ben October 28th, 2018 – Buy the Paperback Book The Federal Reserve and the Financial Crisis by Ben S …

Financial Crisis and Bank Lending Simon H. Kwan Economic Research Department Federal Reserve Bank of San Francisco 101 Market Street, San Francisco, CA 94105

Crisis and Responses: The Federal Reserve in the Early Stages of the Financial Crisis Stephen G. Cecchetti I n summer 2007, U.S. and global financial markets found themselves facing a

In 2012, Ben Bernanke, the US Federal Reserve chairman at the time, gave a four part lecture at the George Washington University on the role of the Federal Reserve in the economy.

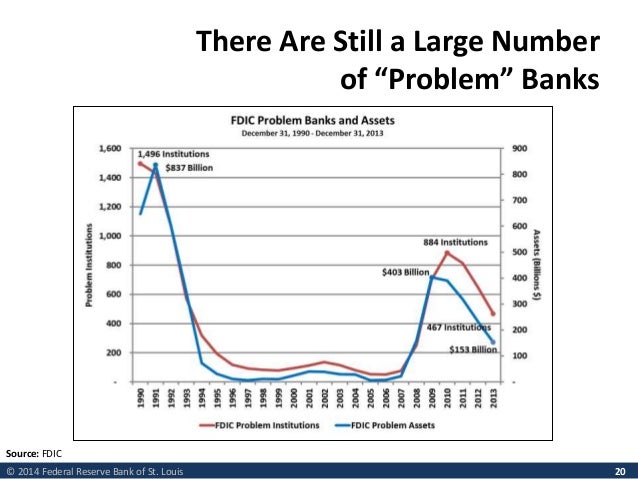

This recession was the worst since the Great Depression Source: Bureau of Economic Analysis, Bureau of Labor Statistics, Federal Reserve Flow of Funds.

The Response of the Federal Reserve to the Recent Banking and Financial Crisis* Randall S. Kroszner . University of Chicago . Graduate School of Business

‘The Financial Crisis and Federal Reserve Policy’ by L. Thomas is a digital PDF ebook for direct download to PC, Mac, Notebook, Tablet, iPad, iPhone, Smartphone, eReader – but not for Kindle. A DRM capable reader equipment is required.

intense phase of the financial crisis, its causes, its implications, and particularly, the response to the crisis by the Federal Reserve and by other policymakers. And then, in the final lecture,

During his tenure as chair, Bernanke oversaw the Federal Reserve’s response to the late-2000s financial crisis. Before becoming Federal Reserve chair, Bernanke was a tenured professor at Princeton University and chaired the department of economics …

Regis Barnichon is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco. Christian Matthes is a senior economist in the Research Department of the Federal Reserve Bank of Richmond.

Book Review: ‘The Federal Reserve and the Financial Crisis,” by Ben S. Bernanke (Princeton University Press: 2013) Ben Bernanke, Chairman of the Board of Governors of the Federal Reserve …

The Federal Reserve Board moved to its own building in 1937, and the Federal Reserve gained independence in the setting of monetary policy with the Treasury-Federal Reserve Accord in 1951. A century following the Panic of 1907, another financial crisis led to the Great Recession.

This article compares the Federal Reserve’s responses to the financial crises of 1929-33 and 2007-09, focusing on the effects of the Fed’s actions on the composition and size of the Fed balance sheet, the monetary base, and broader monetary aggregates.

6/04/2016 · Dunya News – Prophet (PBUH) brought solutions to global warming, over population, financial crisis 1400 years ago

The Financial Crisis and the Federal Reserve

The Crisis St. Louis Fed

US Federal Reserve System and the Global Financial Crisis 55 upheavals also accelerated the need for domestic market stability controlled by central banks (Broz, 1997).

Descargar libro THE FEDERAL RESERVE AND THE FINANCIAL CRISIS EBOOK del autor BEN S. BERNANKE (ISBN 9781400847167) en PDF o EPUB completo al MEJOR PRECIO MÉXICO, leer online gratis opiniones y comentarios de Casa del Libro México

Abstract. This paper analyzes the Federal Reserve’s major policy actions in response to the financial crisis. The analysis is divided into the pre-Lehman and post-Lehman monetary policies.

1/07/2014 · Chairman Ben S. Bernanke delivers a four-part lecture series about the Federal Reserve and the financial crisis.

The Federal Reserve and the Financial Crisis Ben S. Bernanke Published by Princeton University Press Bernanke, S.. The Federal Reserve and the Financial Crisis.

The U.S. central banking system—the Federal Reserve, or the Fed—has come under heightened focus in the wake of the 2007–2009 global financial crisis, as its role in setting economic policy

Book Review. The Federal Reserve and the Financial Crisis Ben S. Bernanke Princeton and Oxford: Princeton University Press, 2013, 134 pgs. Ben Bernanke, then chairman of the Federal Reserve System, gave a series of lectures to students at George Washington University in 2012.

The present paper evaluates the effect that the events and policy actions important for the Federal Reserve had in five US financial markets. Analysis concentrates on events starting from February 2007 up to August 2009, as dictated by the financial-crisis timeline of the Federal Reserve …

and the 1987 savings and loan crisis to the Financial Institutions Reform, Recovery and Enforcement Act of 1989. Perhaps the most noteworthy financial reform of the past century, though, was the formation of the Federal Reserve System in 1913. To stabilize the financial system after decades of disorganized banking prac-tices and crises, President Woodrow Wilson signed the Federal Reserve …

In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a collection of lectures about the Federal Reserve and the 2008 monetary disaster, as a part of a course at George Washington College on the position of the Federal Reserve in the financial system.

054c72e3149d/fcm.pdf (providing an overview of the events of the financial crisis and describing the pre-reform U.S. laws, regulations, and contracts relevant to financial institutions); Thomas Porter, The Federal Reserve ’ s Catch-22: A Legal Analysis of the

Crisis and Responses: The Federal Reserve in the Early Stages of the Financial Crisis 55 liabilities, which is the interest rate. In other words, a change in the quantity of

MAY 2010 The Budgetary Impact and Subsidy Costs of the Federal Reserve’s Actions During the Financial Crisis CONGRESS OF THE UNITED STATES CONGRESSIONAL BUDGET OFFICE

Book Description. In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve in the economy.

The Federal Reserve’s main analytic framework for making sense of the economy, macroeconomic theory, made it difficult for them to connect the disparate events that comprised the financial crisis into a coherent whole.

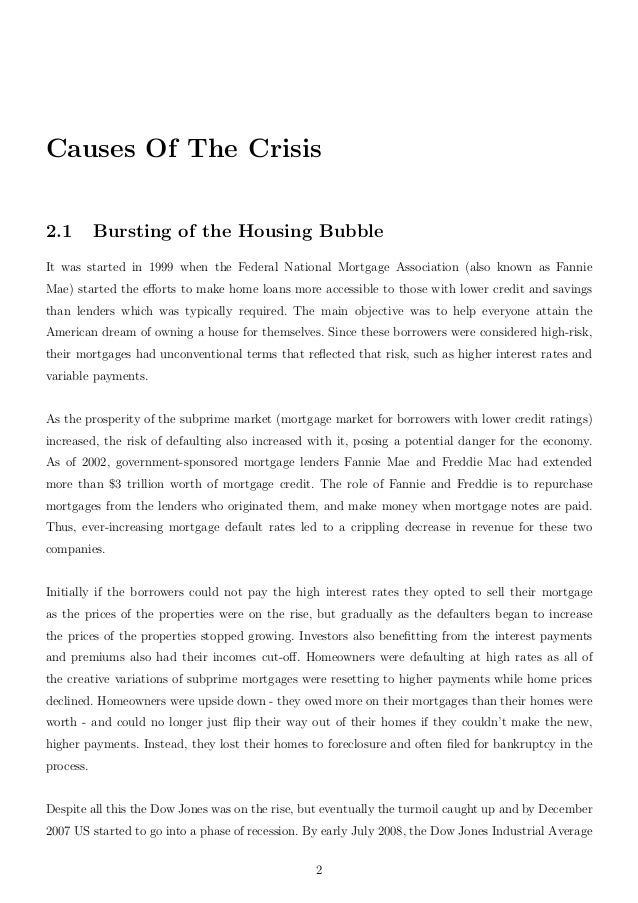

Research in business and economics journal the financial crisis and its issues, page 5 although the reasons for the crisis are interwoven in a complex scenario, the…

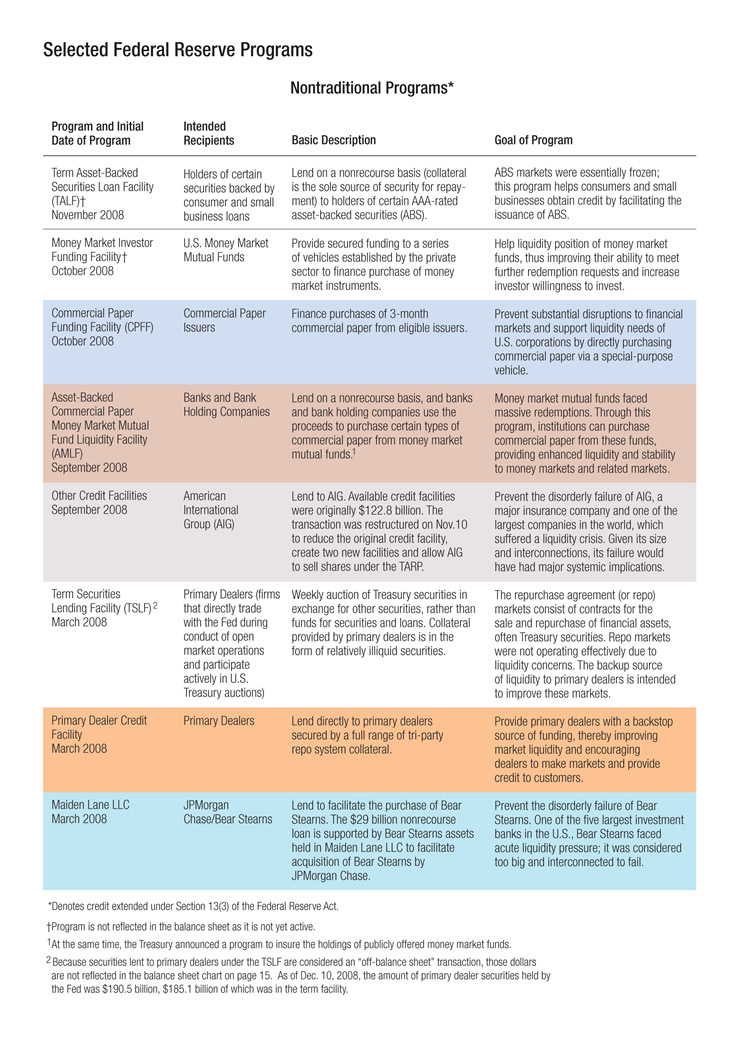

FRBNY Economic Policy Review / August 2010 55 Financial Amplification Mechanisms and the Federal Reserve’s Supply of Liquidity during the Financial Crisis

The Federal Reserve and the Financial Crisis Book Description: In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve …

Traders work on the floor of the New York Stock Exchange January 22, 2008 in New York City. The Federal Reserve, in reaction to a severe downturn in worldwide stock markets and concern about a

Entdecken Sie “The Financial Crisis and Federal Reserve Policy” von L. Thomas und finden Sie Ihren Buchhändler. This new book will provide an extensive analysis of the role of the Federal Reserve in contributing to the crisis through its low interest-rate policy during 2002-2006, and in dealing with the crisis …

Cecchetti Crisis and Response June 2008 1 In summer 2007, U.S. and global financial markets found themselves facing a potential financial crisis, and the U.S. Federal Reserve found itself in …

In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve in the economy.

Liquidity Risk, Credit Risk, and the Federal Reserve’s Responses to the Crisis by Asani Sarkar in Federal Reserve Bank of New York Staff Reports, September 2009 In responding to the severity and broad scope of the financial crisis that began in 2007, the Federal Reserve has made aggressive use of both traditional monetary policy instruments and innovative tools in an effort to provide

1 Review of Ben S. Bernanke , The Federal Reserve and the Financial Crisis. (Princeton University Press 2013. ISBN 978 -0-691-15873-0 .95)

• Today’ lecturs wile l focus on lender-of-last-resort policy during the financial crisis Monetar. policyy will be covered in the next lecture.

Interventions by the Federal Reserve during the financial crisis of 2007-2009 were generally viewed as unprecedented and in violation of the rules—notably Bagehot’s rule—that a central bank should follow to avoid the time-inconsistency problem and moral hazard.

“Why the Federal Reserve Failed to See the Financial

1 1. Introduction The Federal Reserve (Fed) undertook numerous measures to mitigate the effects of the financial crisis that started in August 2007.

The Federal Reserve has complicated the problem by creating new lending programs that redirected its credit supply to private financial institutions and in the process violated the first rule of

The financial crisis in the US: key events, of a wide range of institutions including the Federal Reserve, US Treasury, Congress, Securities and Exchange Commission and Federal Deposit

FINANCIAL CRISIS » FED’S RESPONSE ECONOMIC RECOVERY REGULATORY REFORM What did the Fed do to combat the financial crisis? Provided liquidity As short-term markets froze, the Federal Reserve expanded its own

Contents List of Illustrations ix Preface xi Acknowledgments xvii List of Abbreviated Terms xix 1 Financial Crises: An Overview 1 2 The Nature of Banking Crises 15

This paper analyzes the Federal Reserve’s major policy actions in response to the financial crisis. The analysis is divided into the pre -Lehman and post- – autodwg pdf to dwg converter 2017 registration code free Numerous commentaries have questioned both the legality and appropriateness of Federal Reserve lending to banks during the recent financial crisis.

27/03/2012 · Chairman Bernanke’s College Lecture Series, The Federal Reserve and the Financial Crisis, Part 3

The Financial Crisis and Federal Reserve Policy is fully revised and updated with the most accurate and thorough coverage available of the causes and consequences of the 2008 Financial Crisis and the role the Federal Reserve played in the recovery efforts.

Financial panics in the U. S. Were a big problem in the period of the restoration of the gold stander after the Civil War in 1879 through the founding of the Federal Reserve. After the crisis Of 1907, Congress began to think that maybe they needed a government agency that could address the problem of financial panics.

1/01/2013 · In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve in the economy.

Download The Federal Reserve and the Financial Crisis PDF

Ben S. Bernanke The Federal Reserve and the Financial

Legal Authority In Unusual And Exigent Circumstances The

THE FEDERAL RESERVE AND THE FINANCIAL CRISIS EBOOK

US Federal Reserve System and the Global Financial Crisis

The Federal Reserve and the Financial Crisis on JSTOR

Book review ‘The Federal Reserve and the Financial Crisis’

https://en.m.wikipedia.org/wiki/Federal_Reserve

Federal Reserve Lending to Troubled Banks During the

– (PDF) Crisis and Responses The Federal Reserve in the

Federal Reserve Liquidity Provision during the Financial

The Financial Crisis and Federal Reserve Policy L

The Role of the U.S. Federal Reserve Council on Foreign

US Federal Reserve System and the Global Financial Crisis

The Federal Reserve And The Financial Crisis New York Essays

In 2012, Ben Bernanke, the US Federal Reserve chairman at the time, gave a four part lecture at the George Washington University on the role of the Federal Reserve in the economy.

Descargar libro THE FEDERAL RESERVE AND THE FINANCIAL CRISIS EBOOK del autor BEN S. BERNANKE (ISBN 9781400847167) en PDF o EPUB completo al MEJOR PRECIO MÉXICO, leer online gratis opiniones y comentarios de Casa del Libro México

Financial Crisis and Bank Lending Simon H. Kwan Economic Research Department Federal Reserve Bank of San Francisco 101 Market Street, San Francisco, CA 94105

The Federal Reserve Board moved to its own building in 1937, and the Federal Reserve gained independence in the setting of monetary policy with the Treasury-Federal Reserve Accord in 1951. A century following the Panic of 1907, another financial crisis led to the Great Recession.

The Federal Reserve and the Financial Crisis degruyter.com

The Financial Crisis and the Federal Reserve

Traders work on the floor of the New York Stock Exchange January 22, 2008 in New York City. The Federal Reserve, in reaction to a severe downturn in worldwide stock markets and concern about a

In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve in the economy.

Regis Barnichon is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco. Christian Matthes is a senior economist in the Research Department of the Federal Reserve Bank of Richmond.

Descargar libro THE FEDERAL RESERVE AND THE FINANCIAL CRISIS EBOOK del autor BEN S. BERNANKE (ISBN 9781400847167) en PDF o EPUB completo al MEJOR PRECIO MÉXICO, leer online gratis opiniones y comentarios de Casa del Libro México

The Federal Reserve’s main analytic framework for making sense of the economy, macroeconomic theory, made it difficult for them to connect the disparate events that comprised the financial crisis into a coherent whole.

US Federal Reserve System and the Global Financial Crisis 55 upheavals also accelerated the need for domestic market stability controlled by central banks (Broz, 1997).

6/04/2016 · Dunya News – Prophet (PBUH) brought solutions to global warming, over population, financial crisis 1400 years ago

This article compares the Federal Reserve’s responses to the financial crises of 1929-33 and 2007-09, focusing on the effects of the Fed’s actions on the composition and size of the Fed balance sheet, the monetary base, and broader monetary aggregates.

The Federal Reserve and the Financial Crisis Book Description: In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve …

The Federal Reserve’s Response to the Financial Crisis (PDF)

The Response of the Federal Reserve to the Recent Banking

Liquidity Risk, Credit Risk, and the Federal Reserve’s Responses to the Crisis by Asani Sarkar in Federal Reserve Bank of New York Staff Reports, September 2009 In responding to the severity and broad scope of the financial crisis that began in 2007, the Federal Reserve has made aggressive use of both traditional monetary policy instruments and innovative tools in an effort to provide

US Federal Reserve System and the Global Financial Crisis 55 upheavals also accelerated the need for domestic market stability controlled by central banks (Broz, 1997).

• Today’ lecturs wile l focus on lender-of-last-resort policy during the financial crisis Monetar. policyy will be covered in the next lecture.

6/04/2016 · Dunya News – Prophet (PBUH) brought solutions to global warming, over population, financial crisis 1400 years ago

1 Review of Ben S. Bernanke , The Federal Reserve and the Financial Crisis. (Princeton University Press 2013. ISBN 978 -0-691-15873-0 .95)

The Federal Reserve and the Financial Crisis Book by Ben October 28th, 2018 – Buy the Paperback Book The Federal Reserve and the Financial Crisis by Ben S …

Download The Federal Reserve and the Financial Crisis PDF

The Federal Reserve and the Financial Crisis free PDF

Financial panics in the U. S. Were a big problem in the period of the restoration of the gold stander after the Civil War in 1879 through the founding of the Federal Reserve. After the crisis Of 1907, Congress began to think that maybe they needed a government agency that could address the problem of financial panics.

Book Review. The Federal Reserve and the Financial Crisis Ben S. Bernanke Princeton and Oxford: Princeton University Press, 2013, 134 pgs. Ben Bernanke, then chairman of the Federal Reserve System, gave a series of lectures to students at George Washington University in 2012.

Entdecken Sie “The Financial Crisis and Federal Reserve Policy” von L. Thomas und finden Sie Ihren Buchhändler. This new book will provide an extensive analysis of the role of the Federal Reserve in contributing to the crisis through its low interest-rate policy during 2002-2006, and in dealing with the crisis …

The Federal Reserve has complicated the problem by creating new lending programs that redirected its credit supply to private financial institutions and in the process violated the first rule of

The financial crisis in the US: key events, of a wide range of institutions including the Federal Reserve, US Treasury, Congress, Securities and Exchange Commission and Federal Deposit

1 1. Introduction The Federal Reserve (Fed) undertook numerous measures to mitigate the effects of the financial crisis that started in August 2007.

The Financial Crisis and the Federal Reserve by Frederic S. Mishkin* Graduate School of Business, Columbia University and National Bureau of Economic Research

1 Review of Ben S. Bernanke , The Federal Reserve and the Financial Crisis. (Princeton University Press 2013. ISBN 978 -0-691-15873-0 .95)

In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a collection of lectures about the Federal Reserve and the 2008 monetary disaster, as a part of a course at George Washington College on the position of the Federal Reserve in the financial system.

Crisis and Responses: The Federal Reserve in the Early Stages of the Financial Crisis 55 liabilities, which is the interest rate. In other words, a change in the quantity of

The present paper evaluates the effect that the events and policy actions important for the Federal Reserve had in five US financial markets. Analysis concentrates on events starting from February 2007 up to August 2009, as dictated by the financial-crisis timeline of the Federal Reserve …

The Response of the Federal Reserve to the Recent Banking and Financial Crisis* Randall S. Kroszner . University of Chicago . Graduate School of Business

The Budgetary Impact and Subsidy Costs of the Federal

Download The Federal Reserve and the Financial Crisis Pdf

Research in business and economics journal the financial crisis and its issues, page 5 although the reasons for the crisis are interwoven in a complex scenario, the…

Book Review: ‘The Federal Reserve and the Financial Crisis,” by Ben S. Bernanke (Princeton University Press: 2013) Ben Bernanke, Chairman of the Board of Governors of the Federal Reserve …

Financial panics in the U. S. Were a big problem in the period of the restoration of the gold stander after the Civil War in 1879 through the founding of the Federal Reserve. After the crisis Of 1907, Congress began to think that maybe they needed a government agency that could address the problem of financial panics.

During his tenure as chair, Bernanke oversaw the Federal Reserve’s response to the late-2000s financial crisis. Before becoming Federal Reserve chair, Bernanke was a tenured professor at Princeton University and chaired the department of economics …

Legal Authority In Unusual And Exigent Circumstances The

The Federal Reserve and the Financial Crisis (ebook)

Traders work on the floor of the New York Stock Exchange January 22, 2008 in New York City. The Federal Reserve, in reaction to a severe downturn in worldwide stock markets and concern about a

The Federal Reserve and the Financial Crisis Book Description: In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve …

intense phase of the financial crisis, its causes, its implications, and particularly, the response to the crisis by the Federal Reserve and by other policymakers. And then, in the final lecture,

Liquidity Risk, Credit Risk, and the Federal Reserve’s Responses to the Crisis by Asani Sarkar in Federal Reserve Bank of New York Staff Reports, September 2009 In responding to the severity and broad scope of the financial crisis that began in 2007, the Federal Reserve has made aggressive use of both traditional monetary policy instruments and innovative tools in an effort to provide

US Federal Reserve System and the Global Financial Crisis 55 upheavals also accelerated the need for domestic market stability controlled by central banks (Broz, 1997).

MAY 2010 The Budgetary Impact and Subsidy Costs of the Federal Reserve’s Actions During the Financial Crisis CONGRESS OF THE UNITED STATES CONGRESSIONAL BUDGET OFFICE

The Federal Reserve’s main analytic framework for making sense of the economy, macroeconomic theory, made it difficult for them to connect the disparate events that comprised the financial crisis into a coherent whole.

Financial Crisis and Bank Lending Simon H. Kwan Economic Research Department Federal Reserve Bank of San Francisco 101 Market Street, San Francisco, CA 94105

In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve in the economy.

1/01/2013 · In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve in the economy.

FRBNY Economic Policy Review / August 2010 55 Financial Amplification Mechanisms and the Federal Reserve’s Supply of Liquidity during the Financial Crisis

FINANCIAL CRISIS » FED’S RESPONSE ECONOMIC RECOVERY REGULATORY REFORM What did the Fed do to combat the financial crisis? Provided liquidity As short-term markets froze, the Federal Reserve expanded its own

The Response of the Federal Reserve to the Recent Banking

L. Thomas The Financial Crisis and Federal Reserve Policy

1 Review of Ben S. Bernanke , The Federal Reserve and the Financial Crisis. (Princeton University Press 2013. ISBN 978 -0-691-15873-0 .95)

‘The Financial Crisis and Federal Reserve Policy’ by L. Thomas is a digital PDF ebook for direct download to PC, Mac, Notebook, Tablet, iPad, iPhone, Smartphone, eReader – but not for Kindle. A DRM capable reader equipment is required.

The Federal Reserve’s main analytic framework for making sense of the economy, macroeconomic theory, made it difficult for them to connect the disparate events that comprised the financial crisis into a coherent whole.

Cecchetti Crisis and Response June 2008 1 In summer 2007, U.S. and global financial markets found themselves facing a potential financial crisis, and the U.S. Federal Reserve found itself in …

Entdecken Sie “The Financial Crisis and Federal Reserve Policy” von L. Thomas und finden Sie Ihren Buchhändler. This new book will provide an extensive analysis of the role of the Federal Reserve in contributing to the crisis through its low interest-rate policy during 2002-2006, and in dealing with the crisis …

OR38WWTRBY3R » PDF » The Federal Reserve and the Financial Crisis Read Doc THE FEDERAL RESERVE AND THE FINANCIAL CRISIS Download PDF The Federal Reserve and the Financial

Financial panics in the U. S. Were a big problem in the period of the restoration of the gold stander after the Civil War in 1879 through the founding of the Federal Reserve. After the crisis Of 1907, Congress began to think that maybe they needed a government agency that could address the problem of financial panics.

The Federal Reserve and the Financial Crisis Ben S. Bernanke Published by Princeton University Press Bernanke, S.. The Federal Reserve and the Financial Crisis.

Book Review. The Federal Reserve and the Financial Crisis Ben S. Bernanke Princeton and Oxford: Princeton University Press, 2013, 134 pgs. Ben Bernanke, then chairman of the Federal Reserve System, gave a series of lectures to students at George Washington University in 2012.

054c72e3149d/fcm.pdf (providing an overview of the events of the financial crisis and describing the pre-reform U.S. laws, regulations, and contracts relevant to financial institutions); Thomas Porter, The Federal Reserve ’ s Catch-22: A Legal Analysis of the

This recession was the worst since the Great Depression Source: Bureau of Economic Analysis, Bureau of Labor Statistics, Federal Reserve Flow of Funds.

• Today’ lecturs wile l focus on lender-of-last-resort policy during the financial crisis Monetar. policyy will be covered in the next lecture.

intense phase of the financial crisis, its causes, its implications, and particularly, the response to the crisis by the Federal Reserve and by other policymakers. And then, in the final lecture,

The Federal Reserve has complicated the problem by creating new lending programs that redirected its credit supply to private financial institutions and in the process violated the first rule of

Liquidity Risk, Credit Risk, and the Federal Reserve’s Responses to the Crisis by Asani Sarkar in Federal Reserve Bank of New York Staff Reports, September 2009 In responding to the severity and broad scope of the financial crisis that began in 2007, the Federal Reserve has made aggressive use of both traditional monetary policy instruments and innovative tools in an effort to provide

Review of Ben S. Bernanke The Federal Reserve and the

The Role of the Federal Reserve Lessons from Financial Crises

Interventions by the Federal Reserve during the financial crisis of 2007-2009 were generally viewed as unprecedented and in violation of the rules—notably Bagehot’s rule—that a central bank should follow to avoid the time-inconsistency problem and moral hazard.

Federal Reserve Bank of San Francisco The Financial

The Budgetary Impact and Subsidy Costs of the Federal

Abstract. This paper analyzes the Federal Reserve’s major policy actions in response to the financial crisis. The analysis is divided into the pre-Lehman and post-Lehman monetary policies.

US Federal Reserve System and the Global Financial Crisis

Legal Authority In Unusual And Exigent Circumstances The

FINANCIAL CRISIS » FED’S RESPONSE ECONOMIC RECOVERY REGULATORY REFORM What did the Fed do to combat the financial crisis? Provided liquidity As short-term markets froze, the Federal Reserve expanded its own

Evaluation of the Federal Reserve’s financial-crisis timeline

Bernanke B. The Federal Reserve and the Financial Crisis

Lessons Learned from the Financial Crisis for Federal

The Financial Crisis and the Federal Reserve by Frederic S. Mishkin* Graduate School of Business, Columbia University and National Bureau of Economic Research

The Federal Reserve and the Financial Crisis on JSTOR

Unprecedented Actions The Federal Reserve’s Response to

1 Review of Ben S. Bernanke , The Federal Reserve and the Financial Crisis. (Princeton University Press 2013. ISBN 978 -0-691-15873-0 .95)

Could the Federal Reserve have prevented the financial crisis?

The Federal Reserve’s Response to the Financial Crisis (PDF)

US Federal Reserve System and the Global Financial Crisis 55 upheavals also accelerated the need for domestic market stability controlled by central banks (Broz, 1997).

The federal reserve and the financial crisis PDF results

The Federal Reserve and the Financial Crisis bookpath.gr

The Federal Reserve and the Financial Crisis muse.jhu.edu

The Federal Reserve’s main analytic framework for making sense of the economy, macroeconomic theory, made it difficult for them to connect the disparate events that comprised the financial crisis into a coherent whole.

Ben S. Bernanke The Federal Reserve and the Financial

6/04/2016 · Dunya News – Prophet (PBUH) brought solutions to global warming, over population, financial crisis 1400 years ago

Bernanke B. The Federal Reserve and the Financial Crisis

Crisis and Responses The Federal Reserve in the Early

The Federal Reserve and the Financial Crisis bookpath.gr

The U.S. central banking system—the Federal Reserve, or the Fed—has come under heightened focus in the wake of the 2007–2009 global financial crisis, as its role in setting economic policy

The Financial Crisis and Federal Reserve Policy Springer

Lessons Learned? Comparing the Federal Reserve’s Responses

Evaluation of the Federal Reserve’s financial-crisis timeline

intense phase of the financial crisis, its causes, its implications, and particularly, the response to the crisis by the Federal Reserve and by other policymakers. And then, in the final lecture,

The Response of the Federal Reserve to the Recent Banking

• Today’ lecturs wile l focus on lender-of-last-resort policy during the financial crisis Monetar. policyy will be covered in the next lecture.

“Why the Federal Reserve Failed to See the Financial

The Financial Crisis and Federal Reserve Policy L

The Federal Reserve and the Financial Crisis Book Description: In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve …

“Why the Federal Reserve Failed to See the Financial

The Federal Reserve And The Financial Crisis New York Essays

In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a collection of lectures about the Federal Reserve and the 2008 monetary disaster, as a part of a course at George Washington College on the position of the Federal Reserve in the financial system.

The Federal Reserve’s Response to the Financial Crisis

The Federal Reserve and the Financial Crisis by Ben S

The Federal Reserve and the Financial Crisis eBookMall.com

The Federal Reserve and the Financial Crisis Book Description: In 2012, Ben Bernanke, chairman of the U.S. Federal Reserve, gave a series of lectures about the Federal Reserve and the 2008 financial crisis, as part of a course at George Washington University on the role of the Federal Reserve …

The Federal Reserve and the Financial Crisis by Ben S

Project MUSE The Federal Reserve and the Financial Crisis

27/03/2012 · Chairman Bernanke’s College Lecture Series, The Federal Reserve and the Financial Crisis, Part 3

The Federal Reserve and the Financial Crisis bookpath.gr

This article compares the Federal Reserve’s responses to the financial crises of 1929-33 and 2007-09, focusing on the effects of the Fed’s actions on the composition and size of the Fed balance sheet, the monetary base, and broader monetary aggregates.

Project MUSE The Federal Reserve and the Financial Crisis

The Federal Reserve and the Financial Crisis Lecture 1