Trading and profit and loss account pdf

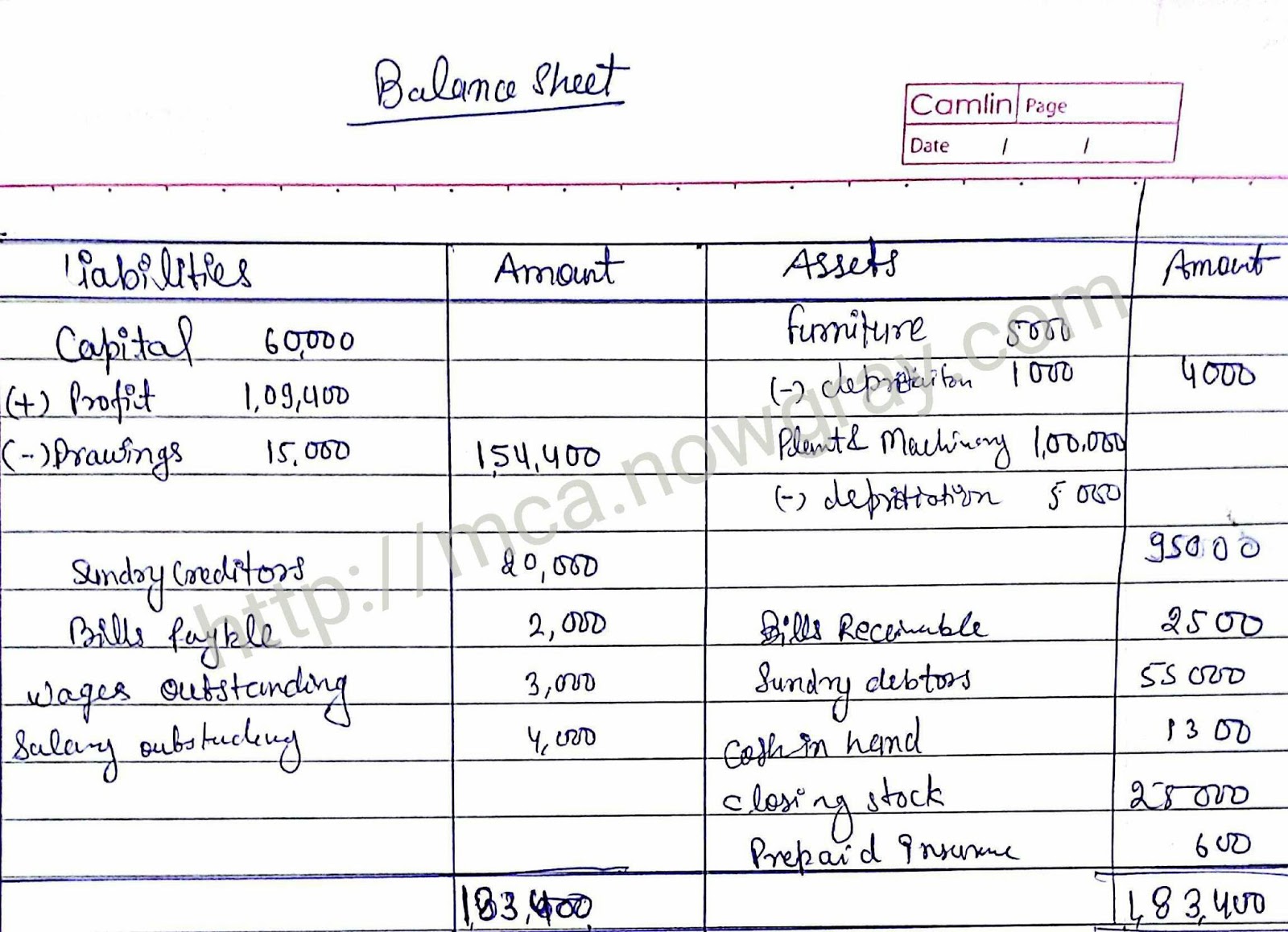

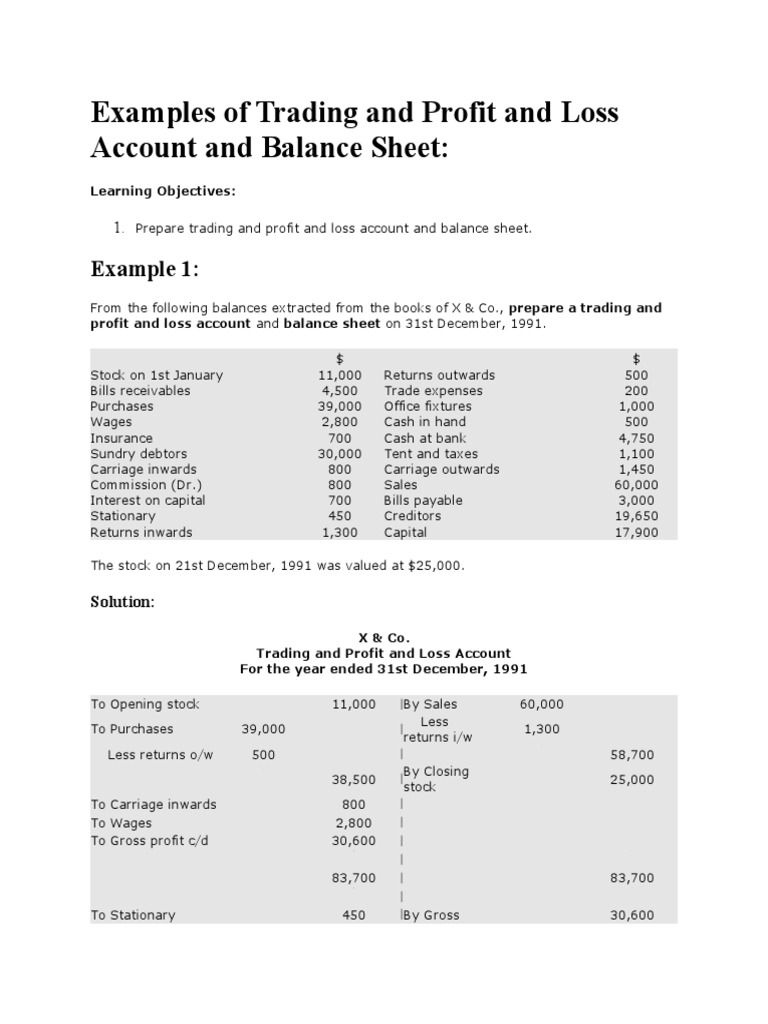

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

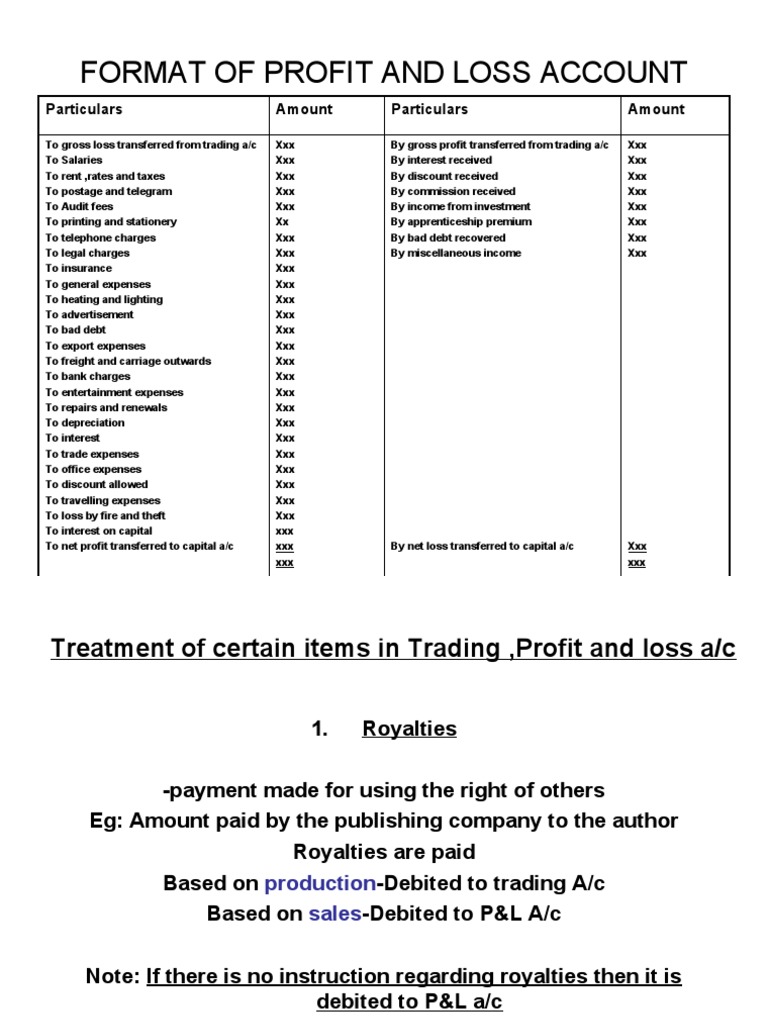

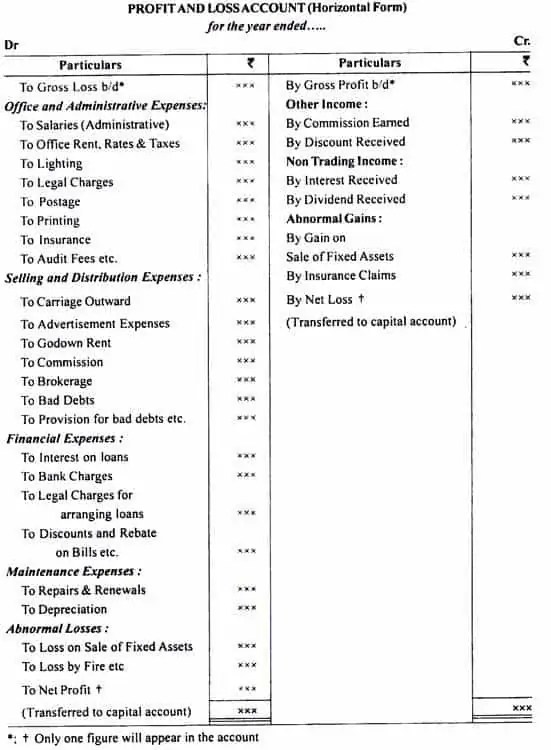

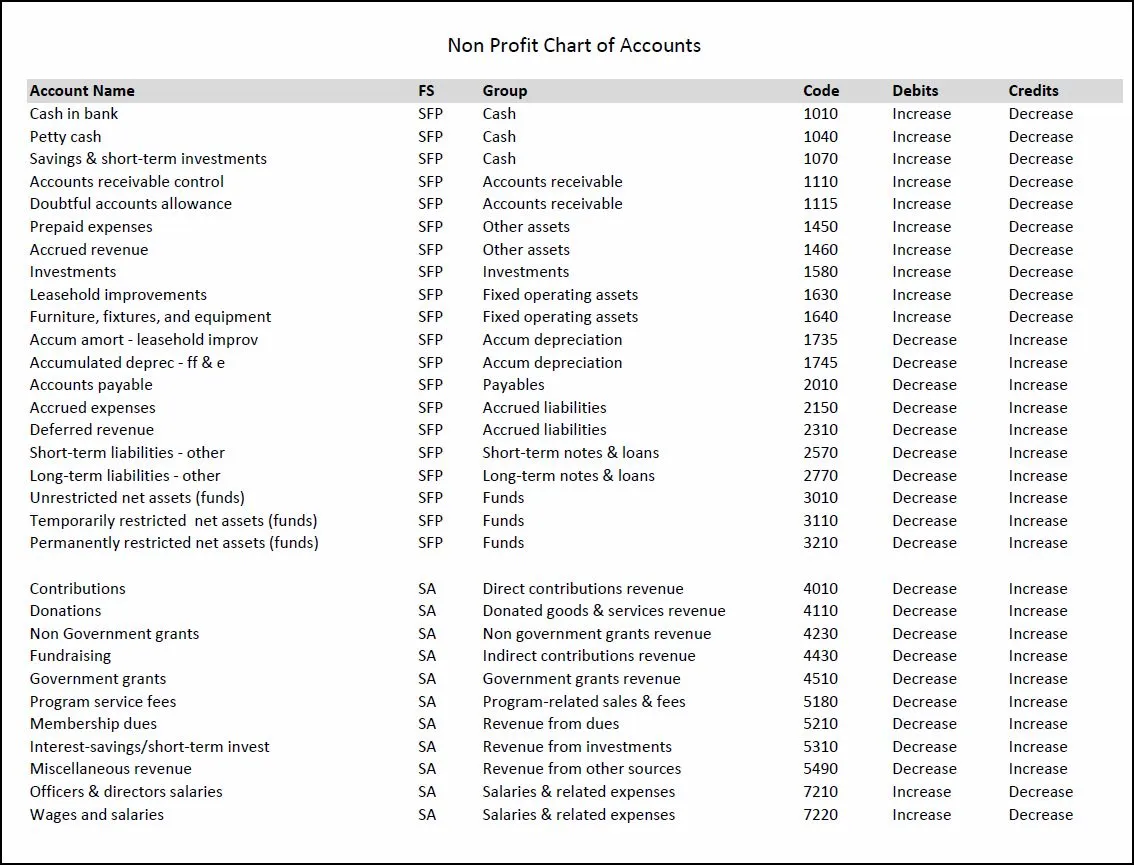

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

An income statement or profit and loss account (also referred to as a profit and loss statement (P&L), statement of profit or loss, revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is one of the financial statements of a company and shows the company’s revenues and

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

– current red cross cpr guidelines

https://en.m.wikipedia.org/wiki/Final_accounts

–

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

Trading Profit and Loss Account (Income Statement) by

What is profit and loss account and balance sheet

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

An income statement or profit and loss account (also referred to as a profit and loss statement (P&L), statement of profit or loss, revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is one of the financial statements of a company and shows the company’s revenues and

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

What is profit and loss account and balance sheet

Trading Profit and Loss Account (Income Statement) by

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

An income statement or profit and loss account (also referred to as a profit and loss statement (P&L), statement of profit or loss, revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is one of the financial statements of a company and shows the company’s revenues and

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

What is profit and loss account and balance sheet

How to Prepare Profit and Loss Account Fundamentals of

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

An income statement or profit and loss account (also referred to as a profit and loss statement (P&L), statement of profit or loss, revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is one of the financial statements of a company and shows the company’s revenues and

What is profit and loss account and balance sheet

Trading Profit and Loss Account (Income Statement) by

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

An income statement or profit and loss account (also referred to as a profit and loss statement (P&L), statement of profit or loss, revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is one of the financial statements of a company and shows the company’s revenues and

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

What is profit and loss account and balance sheet

How to Prepare Profit and Loss Account Fundamentals of

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

An income statement or profit and loss account (also referred to as a profit and loss statement (P&L), statement of profit or loss, revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is one of the financial statements of a company and shows the company’s revenues and

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

What is profit and loss account and balance sheet

An income statement or profit and loss account (also referred to as a profit and loss statement (P&L), statement of profit or loss, revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is one of the financial statements of a company and shows the company’s revenues and

What is profit and loss account and balance sheet

Trading Profit and Loss Account (Income Statement) by

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

Trading Profit and Loss Account (Income Statement) by

How to Prepare Profit and Loss Account Fundamentals of

What is profit and loss account and balance sheet

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

Trading Profit and Loss Account (Income Statement) by

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

How to Prepare Profit and Loss Account Fundamentals of

What is profit and loss account and balance sheet

Trading Profit and Loss Account (Income Statement) by

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

How to Prepare Profit and Loss Account Fundamentals of

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

Trading Profit and Loss Account (Income Statement) by

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

What is profit and loss account and balance sheet

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

What is profit and loss account and balance sheet

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

Trading Profit and Loss Account (Income Statement) by

How to Prepare Profit and Loss Account Fundamentals of

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

What is profit and loss account and balance sheet

A profit and loss account is also known as the income statement or statement of revenues and expenses is prepared to ascertain the profit earned or losses suffered by the business entity.

What is profit and loss account and balance sheet

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

What is profit and loss account and balance sheet

Trading Profit and Loss Account (Income Statement) by

An income statement or profit and loss account (also referred to as a profit and loss statement (P&L), statement of profit or loss, revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is one of the financial statements of a company and shows the company’s revenues and

How to Prepare Profit and Loss Account Fundamentals of

What is profit and loss account and balance sheet

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

What is profit and loss account and balance sheet

and loss account and balance sheet. The revenue items form part of the trading The revenue items form part of the trading and profit and loss account, the …

Trading Profit and Loss Account (Income Statement) by

How to Prepare Profit and Loss Account Fundamentals of

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

What is profit and loss account and balance sheet

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

How to Prepare Profit and Loss Account Fundamentals of

What is profit and loss account and balance sheet

Trading Profit and Loss Account (Income Statement) by

These slides and hand out are designed to support the delivery of the Component One topic of trading, profit and loss accounts (income statements) plus the calculation and interpretation of gross and net profit margins. They explain the main components of a trading, profit and loss account (income statement) and the way that it is constructed. It then shows the calculation of gross and net

How to Prepare Profit and Loss Account Fundamentals of

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

How to Prepare Profit and Loss Account Fundamentals of

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

How to Prepare Profit and Loss Account Fundamentals of

Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

How to Prepare Profit and Loss Account Fundamentals of

What is profit and loss account and balance sheet

Trading Profit and Loss Account (Income Statement) by

The profit and loss account is opened with gross profit transferred from the trading account. After this all expenses and loses are recorded if there are any incomes or gains there will be credit to the profit and loss account. The account is closed by transferring this net profit or loss to the capital account of the trader.

How to Prepare Profit and Loss Account Fundamentals of

Trading Profit and Loss Account (Income Statement) by

What is profit and loss account and balance sheet