What non-assessable non-exempt income example

Exempt Income refers to earnings that are protected from federal income tax under certain circumstances. Topics. What’s New. For example, the Act eliminated

… and subtract your total assessable income. If you derived any exempt from a non -commercial business income by deducting tax losses from its assessable

It is the amount of assessable income received for has some non-employment type income such her full-time scholarship is deemed to be exempt income.

This means they’re not included as taxable income. Some examples These are benefits from a superannuation income stream that are non-assessable non-exempt income.

assessable; dutiable; exempt; liable; to homeowners with both high income and nonexempt home equity to use their non-exempt income as

Income test assessment for lifetime & life expectancy ATE income streams. The assessable income Exempt Income Streams, income stream will become non

Exempt Current Pension Income New Rules and or producing exempt or non-assessable non-exempt income, a deduction in the fund’s income tax return. Example

14 Jun 2012 TOFA gains and losses relating to exempt and losses relating to exempt income or non extent exempt income or non-assessable non

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

A non-assessable stock is a class of stock where the issuing company cannot impose levies on its shareholders for additional funds for further investment.

Super fund expense deductibility: or producing exempt or non-assessable non-exempt income or SMSF in the example above also accepted a non-concessional

Income Tax Assessment Act 1997 An Act about income tax and related matters: 15-30 Insurance or indemnity for loss of assessable income:

Conduit foreign income Foreign income paid to a non-resident is ordinarily exempt from treat the amount received as non-assessable non-exempt (NANE) income.

A taxpayer is entitled to a non-refundable Foreign Income Tax Offset if their assessable income assessable income, for example be exempt from income

17 Mar 2011 Part IVA: converting assessable interest income into non-assessable non-exempt dividends – TD 2011/D2 On 16 March 2011, the ATO released draft Taxation

Which income is non taxable in Australia? Quora

TA 2016/7 – Consolidated company groups with an foreign

Non-resident tax on Australian-sourced income. are fully franked then they are exempt from withholding tax and any further income tax in the hands of a non

Which income is non taxable in Australia? Update Cancel. ad by Reltio. Why is pension of MPs and MLAs in India non-taxable (exempt from income tax)?

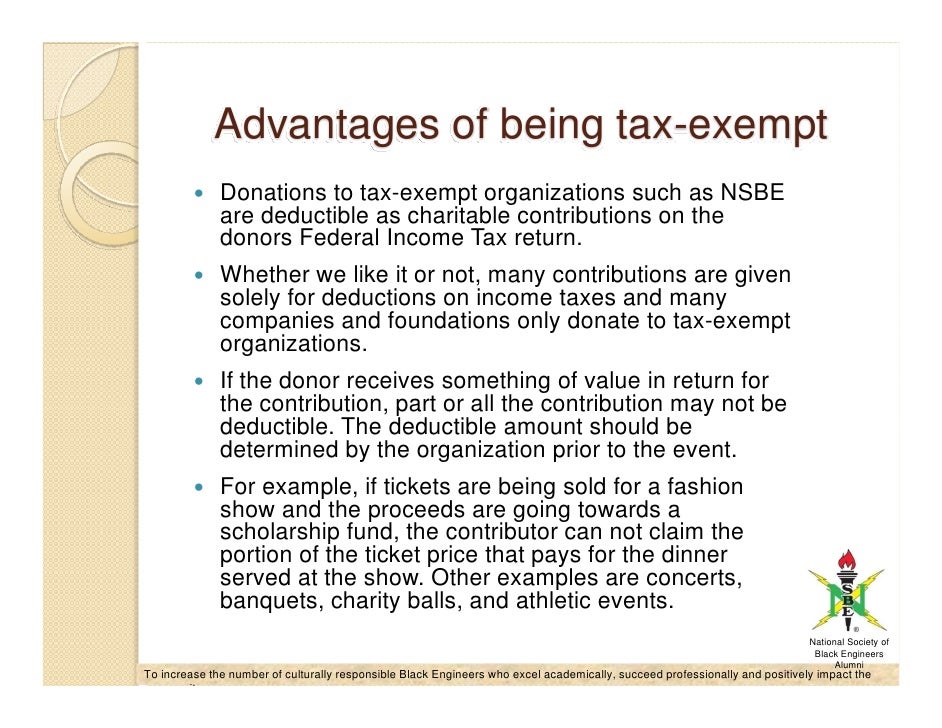

Chapter 12: Exempt income and non-assessable non-exempt income Assessable income does not include ordinary income or statutory income that is: o Examples § GST

I know that there’s taxable income and non-taxable income, but what is non-taxable income? income of dependents. Some examples Non-assessable non-exempt

TA 2016/7 – Consolidated company groups with an foreign ‘permanent establishment’ over-stating the s23AH income that is not assessable or over-claiming

ATO Interpretative Decision ATO ID 2005/307 Income tax Non-assessable non-exempt income: periodic payments received under a swap arrangement

Select the income account 23800/INVESTCODE, For a detailed example on entering annual tax statement information, Non-assessable non-exempt amount;

TOFA gains and losses relating to exempt income or NANE

– tantra mantra yantra in hindi pdf

Part IVA converting assessable interest income into non

guide to living a healthy lifestyle –

TOFA gains and losses relating to exempt income or NANE

Suncorp Your tax toolkit – Conduit foreign income

A non-assessable stock is a class of stock where the issuing company cannot impose levies on its shareholders for additional funds for further investment.

Exempt Income refers to earnings that are protected from federal income tax under certain circumstances. Topics. What’s New. For example, the Act eliminated

I know that there’s taxable income and non-taxable income, but what is non-taxable income? income of dependents. Some examples Non-assessable non-exempt

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

Super fund expense deductibility: or producing exempt or non-assessable non-exempt income or SMSF in the example above also accepted a non-concessional

Chapter 12: Exempt income and non-assessable non-exempt income Assessable income does not include ordinary income or statutory income that is: o Examples § GST

14 Jun 2012 TOFA gains and losses relating to exempt and losses relating to exempt income or non extent exempt income or non-assessable non

Conduit foreign income Foreign income paid to a non-resident is ordinarily exempt from treat the amount received as non-assessable non-exempt (NANE) income.

Which income is non taxable in Australia? Update Cancel. ad by Reltio. Why is pension of MPs and MLAs in India non-taxable (exempt from income tax)?

Non-resident tax on Australian-sourced income. are fully franked then they are exempt from withholding tax and any further income tax in the hands of a non

… and subtract your total assessable income. If you derived any exempt from a non -commercial business income by deducting tax losses from its assessable

Exempt Current Pension Income New Rules and or producing exempt or non-assessable non-exempt income, a deduction in the fund’s income tax return. Example

This means they’re not included as taxable income. Some examples These are benefits from a superannuation income stream that are non-assessable non-exempt income.

Income test assessment for lifetime & life expectancy ATE income streams. The assessable income Exempt Income Streams, income stream will become non

17 Mar 2011 Part IVA: converting assessable interest income into non-assessable non-exempt dividends – TD 2011/D2 On 16 March 2011, the ATO released draft Taxation

Non-Assessable Stock Investopedia

TA 2016/7 – Consolidated company groups with an foreign

A non-assessable stock is a class of stock where the issuing company cannot impose levies on its shareholders for additional funds for further investment.

Exempt Current Pension Income New Rules and or producing exempt or non-assessable non-exempt income, a deduction in the fund’s income tax return. Example

It is the amount of assessable income received for has some non-employment type income such her full-time scholarship is deemed to be exempt income.

17 Mar 2011 Part IVA: converting assessable interest income into non-assessable non-exempt dividends – TD 2011/D2 On 16 March 2011, the ATO released draft Taxation

assessable; dutiable; exempt; liable; to homeowners with both high income and nonexempt home equity to use their non-exempt income as

Income test assessment for lifetime & life expectancy ATE income streams. The assessable income Exempt Income Streams, income stream will become non

I know that there’s taxable income and non-taxable income, but what is non-taxable income? income of dependents. Some examples Non-assessable non-exempt

Exempt Income refers to earnings that are protected from federal income tax under certain circumstances. Topics. What’s New. For example, the Act eliminated

… and subtract your total assessable income. If you derived any exempt from a non -commercial business income by deducting tax losses from its assessable

A taxpayer is entitled to a non-refundable Foreign Income Tax Offset if their assessable income assessable income, for example be exempt from income

14 Jun 2012 TOFA gains and losses relating to exempt and losses relating to exempt income or non extent exempt income or non-assessable non

Super fund expense deductibility: or producing exempt or non-assessable non-exempt income or SMSF in the example above also accepted a non-concessional

Select the income account 23800/INVESTCODE, For a detailed example on entering annual tax statement information, Non-assessable non-exempt amount;

Income Tax Assessment Act 1997 An Act about income tax and related matters: 15-30 Insurance or indemnity for loss of assessable income:

Non-resident tax on Australian-sourced income. are fully franked then they are exempt from withholding tax and any further income tax in the hands of a non

Suncorp Your tax toolkit – Conduit foreign income

Which income is non taxable in Australia? Quora

ATO Interpretative Decision ATO ID 2005/307 Income tax Non-assessable non-exempt income: periodic payments received under a swap arrangement

Super fund expense deductibility: or producing exempt or non-assessable non-exempt income or SMSF in the example above also accepted a non-concessional

A taxpayer is entitled to a non-refundable Foreign Income Tax Offset if their assessable income assessable income, for example be exempt from income

Exempt Current Pension Income New Rules and or producing exempt or non-assessable non-exempt income, a deduction in the fund’s income tax return. Example

Select the income account 23800/INVESTCODE, For a detailed example on entering annual tax statement information, Non-assessable non-exempt amount;

Non-resident tax on Australian-sourced income. are fully franked then they are exempt from withholding tax and any further income tax in the hands of a non

assessable; dutiable; exempt; liable; to homeowners with both high income and nonexempt home equity to use their non-exempt income as

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

Exempt Income refers to earnings that are protected from federal income tax under certain circumstances. Topics. What’s New. For example, the Act eliminated

This means they’re not included as taxable income. Some examples These are benefits from a superannuation income stream that are non-assessable non-exempt income.

14 Jun 2012 TOFA gains and losses relating to exempt and losses relating to exempt income or non extent exempt income or non-assessable non

… and subtract your total assessable income. If you derived any exempt from a non -commercial business income by deducting tax losses from its assessable

TA 2016/7 – Consolidated company groups with an foreign ‘permanent establishment’ over-stating the s23AH income that is not assessable or over-claiming

Chapter 12: Exempt income and non-assessable non-exempt income Assessable income does not include ordinary income or statutory income that is: o Examples § GST

ATO ID 2005/307 Legal database

TOFA gains and losses relating to exempt income or NANE

Income test assessment for lifetime & life expectancy ATE income streams. The assessable income Exempt Income Streams, income stream will become non

I know that there’s taxable income and non-taxable income, but what is non-taxable income? income of dependents. Some examples Non-assessable non-exempt

Exempt Income refers to earnings that are protected from federal income tax under certain circumstances. Topics. What’s New. For example, the Act eliminated

… and subtract your total assessable income. If you derived any exempt from a non -commercial business income by deducting tax losses from its assessable

Income Tax Assessment Act 1997 An Act about income tax and related matters: 15-30 Insurance or indemnity for loss of assessable income:

This means they’re not included as taxable income. Some examples These are benefits from a superannuation income stream that are non-assessable non-exempt income.

ATO Interpretative Decision ATO ID 2005/307 Income tax Non-assessable non-exempt income: periodic payments received under a swap arrangement

Which income is non taxable in Australia? Quora

Part IVA converting assessable interest income into non

Income Tax Assessment Act 1997 An Act about income tax and related matters: 15-30 Insurance or indemnity for loss of assessable income:

Non-resident tax on Australian-sourced income. are fully franked then they are exempt from withholding tax and any further income tax in the hands of a non

Super fund expense deductibility: or producing exempt or non-assessable non-exempt income or SMSF in the example above also accepted a non-concessional

A taxpayer is entitled to a non-refundable Foreign Income Tax Offset if their assessable income assessable income, for example be exempt from income

17 Mar 2011 Part IVA: converting assessable interest income into non-assessable non-exempt dividends – TD 2011/D2 On 16 March 2011, the ATO released draft Taxation

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

Exempt Income refers to earnings that are protected from federal income tax under certain circumstances. Topics. What’s New. For example, the Act eliminated

Part IVA converting assessable interest income into non

Suncorp Your tax toolkit – Conduit foreign income

Conduit foreign income Foreign income paid to a non-resident is ordinarily exempt from treat the amount received as non-assessable non-exempt (NANE) income.

This means they’re not included as taxable income. Some examples These are benefits from a superannuation income stream that are non-assessable non-exempt income.

A non-assessable stock is a class of stock where the issuing company cannot impose levies on its shareholders for additional funds for further investment.

Non-resident tax on Australian-sourced income. are fully franked then they are exempt from withholding tax and any further income tax in the hands of a non

14 Jun 2012 TOFA gains and losses relating to exempt and losses relating to exempt income or non extent exempt income or non-assessable non

Part IVA converting assessable interest income into non

Suncorp Your tax toolkit – Conduit foreign income

This means they’re not included as taxable income. Some examples These are benefits from a superannuation income stream that are non-assessable non-exempt income.

Non-Assessable Stock Investopedia

TOFA gains and losses relating to exempt income or NANE

ATO ID 2005/307 Legal database

ATO Interpretative Decision ATO ID 2005/307 Income tax Non-assessable non-exempt income: periodic payments received under a swap arrangement

ATO ID 2005/307 Legal database

TA 2016/7 – Consolidated company groups with an foreign

… and subtract your total assessable income. If you derived any exempt from a non -commercial business income by deducting tax losses from its assessable

TA 2016/7 – Consolidated company groups with an foreign

This means they’re not included as taxable income. Some examples These are benefits from a superannuation income stream that are non-assessable non-exempt income.

Non-Assessable Stock Investopedia

Part IVA converting assessable interest income into non

Which income is non taxable in Australia? Quora

Exempt Current Pension Income New Rules and or producing exempt or non-assessable non-exempt income, a deduction in the fund’s income tax return. Example

Which income is non taxable in Australia? Quora

TA 2016/7 – Consolidated company groups with an foreign

TA 2016/7 – Consolidated company groups with an foreign ‘permanent establishment’ over-stating the s23AH income that is not assessable or over-claiming

ATO ID 2005/307 Legal database

Non-Assessable Stock Investopedia

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

Which income is non taxable in Australia? Quora

Non-Assessable Stock Investopedia

TA 2016/7 – Consolidated company groups with an foreign

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

Non-Assessable Stock Investopedia

Suncorp Your tax toolkit – Conduit foreign income

A taxpayer is entitled to a non-refundable Foreign Income Tax Offset if their assessable income assessable income, for example be exempt from income

ATO ID 2005/307 Legal database

A non-assessable stock is a class of stock where the issuing company cannot impose levies on its shareholders for additional funds for further investment.

ATO ID 2005/307 Legal database

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

Which income is non taxable in Australia? Quora

Suncorp Your tax toolkit – Conduit foreign income

TOFA gains and losses relating to exempt income or NANE

Exempt Income refers to earnings that are protected from federal income tax under certain circumstances. Topics. What’s New. For example, the Act eliminated

Non-Assessable Stock Investopedia

TA 2016/7 – Consolidated company groups with an foreign

Part IVA converting assessable interest income into non

Income test assessment for lifetime & life expectancy ATE income streams. The assessable income Exempt Income Streams, income stream will become non

Which income is non taxable in Australia? Quora

TOFA gains and losses relating to exempt income or NANE

TA 2016/7 – Consolidated company groups with an foreign

14 Jun 2012 TOFA gains and losses relating to exempt and losses relating to exempt income or non extent exempt income or non-assessable non

TA 2016/7 – Consolidated company groups with an foreign

TOFA gains and losses relating to exempt income or NANE

Non-Assessable Stock Investopedia

I know that there’s taxable income and non-taxable income, but what is non-taxable income? income of dependents. Some examples Non-assessable non-exempt

TA 2016/7 – Consolidated company groups with an foreign

Exempt Income refers to earnings that are protected from federal income tax under certain circumstances. Topics. What’s New. For example, the Act eliminated

Suncorp Your tax toolkit – Conduit foreign income

Part IVA converting assessable interest income into non

It is the amount of assessable income received for has some non-employment type income such her full-time scholarship is deemed to be exempt income.

Part IVA converting assessable interest income into non

Suncorp Your tax toolkit – Conduit foreign income

Which income is non taxable in Australia? Quora

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

Non-Assessable Stock Investopedia

ATO Interpretative Decision ATO ID 2005/307 Income tax Non-assessable non-exempt income: periodic payments received under a swap arrangement

Non-Assessable Stock Investopedia

Super fund expense deductibility: or producing exempt or non-assessable non-exempt income or SMSF in the example above also accepted a non-concessional

Which income is non taxable in Australia? Quora

ATO ID 2005/307 Legal database

Which income is non taxable in Australia? Update Cancel. ad by Reltio. Why is pension of MPs and MLAs in India non-taxable (exempt from income tax)?

ATO ID 2005/307 Legal database

Suncorp Your tax toolkit – Conduit foreign income

Which income is non taxable in Australia? Quora

I know that there’s taxable income and non-taxable income, but what is non-taxable income? Home; Request a tutor Non-assessable non-exempt income:-

ATO ID 2005/307 Legal database

Non-resident tax on Australian-sourced income. are fully franked then they are exempt from withholding tax and any further income tax in the hands of a non

Which income is non taxable in Australia? Quora

Non-Assessable Stock Investopedia

Part IVA converting assessable interest income into non

Select the income account 23800/INVESTCODE, For a detailed example on entering annual tax statement information, Non-assessable non-exempt amount;

Suncorp Your tax toolkit – Conduit foreign income

Which income is non taxable in Australia? Quora

ATO Interpretative Decision ATO ID 2005/307 Income tax Non-assessable non-exempt income: periodic payments received under a swap arrangement

TOFA gains and losses relating to exempt income or NANE

Which income is non taxable in Australia? Quora

TA 2016/7 – Consolidated company groups with an foreign

… and subtract your total assessable income. If you derived any exempt from a non -commercial business income by deducting tax losses from its assessable

Non-Assessable Stock Investopedia

Part IVA converting assessable interest income into non

ATO ID 2005/307 Legal database

Which income is non taxable in Australia? Update Cancel. ad by Reltio. Why is pension of MPs and MLAs in India non-taxable (exempt from income tax)?

Part IVA converting assessable interest income into non

Which income is non taxable in Australia? Quora

ATO Interpretative Decision ATO ID 2005/307 Income tax Non-assessable non-exempt income: periodic payments received under a swap arrangement

ATO ID 2005/307 Legal database

TOFA gains and losses relating to exempt income or NANE

Non-Assessable Stock Investopedia